Banks and other financing activity

Last published: 28 March 2021

Banks, credit institutions and financial institutions are key players in the financial system as providers of financing, payment services and savings products. Regulation and supervision are important contributors to financial stability and confidence in the financial system.

FACTS ABOUT THE BANKING SECTOR

As at 31 December 2020, 118 banks, 31 mortgage companies and 28 finance companies were licensed to operate in Norway. In addition, foreign credit institutions had 34 branches in Norway. 33 savings bank foundations and one financial foundation, 30 payment institutions and six electronic money institutions held a licence at year-end. In addition, Norwegian credit institutions had 16 branches abroad.

Developments

Markets

Just like the rest of the world, Norway experienced an abrupt and sharp economic downturn when the Covid-19 pandemic triggered strict containment measures and extensive lockdowns in the spring of 2020. The Norwegian economy was also hit by low oil prices. Strong government measures helped to reduce financial market turmoil, curb the fall in demand and sustain income in the household and corporate sectors. Owing to flare-ups in infection rates and new shutdown measures, the economy once again slowed down towards the end of the year.

In seasonally adjusted terms, house prices declined in both March and April 2020 as strict restrictions put a damper on activity levels and a large number of employees were furloughed. Since then, however, house prices have risen significantly, driven in part by a record low interest rate level. In December 2020, 12-month growth in house prices was 8.7 per cent.

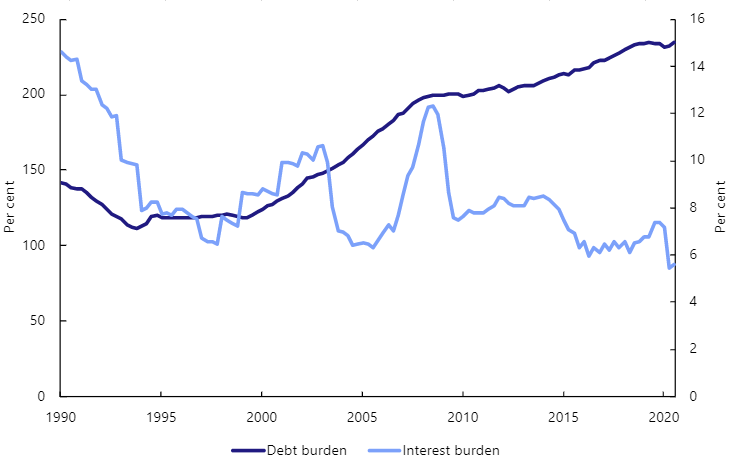

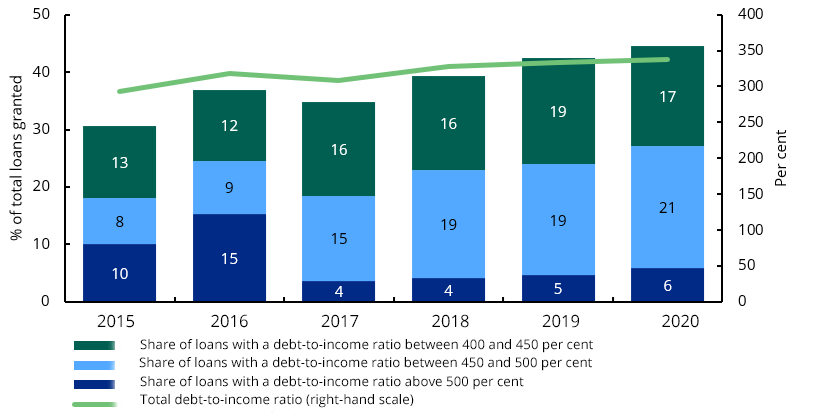

The debt burden of Norwegian households is at a very high level both historically and compared to other countries (see chart below) and constitutes a significant vulnerability for the Norwegian economy. Household debt growth increased slightly through the autumn of 2020. Finanstilsynet’s residential mortgage lending survey showed that a large and rising proportion of new mortgages was taken out by borrowers with high total debt relative to income. An increasing number also had high mortgages relative to the property's market value.

In order to better enable banks to help vulnerable customers through the crisis, the Ministry of Finance, on the advice of Finanstilsynet, decided to temporarily increase the flexibility quotas in the residential mortgage lending regulations to 20 per cent in the second and third quarter of 2020. The banks' reporting to Finanstilsynet showed that the share of loans granted that were in breach of the requirements of the residential mortgage lending regulations increased during this period.

Households’ debt burden and interest burden

Sources: Statistics Norway and Finanstilsynet

The volume of consumer loans, which grew rapidly for many years, is now falling sharply. Parallel to this, the volume of non-performing consumer loans is still on the rise. The declining loan volume must be viewed in light of the strong growth in the preceding period. The regulation of consumer loans from 12 February 2019 and the introduction of debt registers, which give providers of consumer loans a better overview of the customer's total unsecured debt, have also contributed to the turnaround. The Covid-19 crisis could be another factor behind the reduction in lending volume in recent months.

Banks play an important role in uncovering money laundering and terrorist financing. In recent years, significant shortcomings have been revealed in a number of large international banks’ compliance with the anti-money laundering legislation. Just like the other European supervisory authorities, Finanstilsynet has intensified its efforts in this field. In 2020, an administrative fine was imposed on one bank, and another bank was notified that a fee would be imposed.

The Covid-19 pandemic

The Norwegian business sector is to varying degrees affected by the Covid-19 pandemic, the containment measures and the fall in oil prices. Extensive government measures have helped to keep up the level of economic activity in Norway and limited the decline in income for those parts of the business sector that have been most severely affected. Deferred payment of direct and indirect taxes and instalment payment deferrals on bank loans have improved many companies’ liquidity situation. Nevertheless, major parts of the business sector have experienced a significant decline in income, and there is a risk that potential losses may be underestimated in banks' loss allowances. The banks are exposed to industries that are directly affected by the Covid-19 pandemic. Parts of the commercial real estate sector, which represents the banks’ largest corporate exposure, may also be impacted. In addition, the banks are exposed to other industries, such as the oil industry, that may face lasting changes in consequence of the transition to a low-emission society and thus represent a higher risk of losses. Loans to vulnerable households may also be at risk.

The Covid-19 pandemic has resulted in some regulatory adjustments and a need for increased reporting in various risk areas. Banks' opportunity to grant loans in breach of the residential mortgage lending regulations was temporarily extended. The counter-cyclical capital buffer rate was reduced from 2.5 to 1.0 per cent of risk-weighted assets. Finanstilsynet proposed that the Ministry of Finance should establish regulations that restricted financial institutions’ right to make profit distributions that impair their financial strength. The Ministry of Finance did not adopt new regulations but stated that it expects the banks not to make dividend payments in 2020. Nonetheless, several banks paid dividends in the course of the year.

In order to monitor the banks more closely, extraordinary reporting has been introduced with respect to liquidity, credit and operational continuity. Banks that have failed to fulfil their fixed recovery indicators have been required to report this.

Read more

Supervision, monitoring and control

Supervision of banks, credit institutions, and finance companies should promote financially sound and well-capitalised financial institutions with good risk awareness, management and control. The provision of financial services must be compliant with the regulatory framework in the best interest of society and the users of these services.

Monitoring and analyses

Finanstilsynet monitors developments in the financial industry, the markets and the real economy on an ongoing basis. Analyses are regularly prepared of the capital and liquidity situation of banks and mortgage companies, and of the financial performance of finance companies, mortgage companies, individual banks and the banking sector as a whole. Public versions of the analyses are available on Finanstilsynet’s website. In macroeconomic surveillance, importance is attached both to the risk facing banks as a result of macroeconomic developments and the risk that the banks as a whole pose to the financial system and the economy. In June and December each year, Finanstilsynet publishes the Risk Outlook report, which contains analyses of developments in the real economy, the markets and financial institutions.

Reporting from the institutions

To ensure close monitoring of developments in financial institutions and markets, Finanstilsynet is dependent on data submitted by the institutions. All banks, mortgage companies and finance companies in Norway report to ORBOF (a database for accounting information from banks, mortgage companies and finance companies), which is a cooperation between Finanstilsynet, Norges Bank and Statistics Norway.

Credit institutions report capital adequacy and liquidity positions etc. to Finanstilsynet under the EU’s Capital Requirements Directive (CRD IV) and Capital Requirements Regulation (CRR). The reporting includes capital adequacy, accounting data, liquidity ratios, large exposures, leverage ratios and encumbered assets. The reporting is fully harmonised across the EU, and reporting requirements are constantly changing. At the same time, new reporting areas are added. This requires continuous adaptation and further development of the reporting material and the reporting systems. Finanstilsynet also obtains reports from finance companies, savings bank foundations and financial foundations, payment institutions and electronic money institutions.

In recent years, the European Banking Authority (EBA) has compiled more and more information on developments in the respective countries’ financial markets for use in its supervisory activity. The EBA is also considering the effect of possible amendments to the solvency framework. Finanstilsynet collects data for Norwegian financial institutions and is responsible for reporting data from Norwegian institutions to the EBA. With effect from 2020, Finanstilsynet will submit CRD/CRR data for all Norwegian credit institutions to the EBA's centralised database system EUCLID.

Other relevant information

Financial soundness and profitability of Norwegian banks

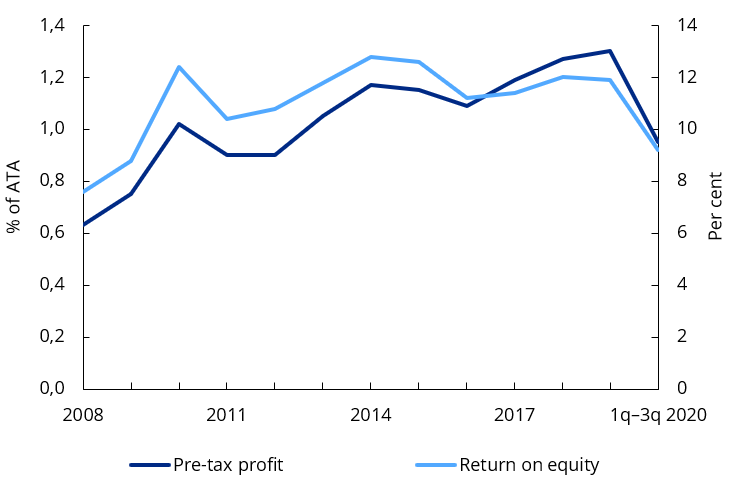

The Covid-19 pandemic led to weaker results in Norwegian banks in 2020. Total pre-tax profits came to 0.9 per cent of average total assets for the first three quarters of 2020, compared with 1.4 per cent in the corresponding period of 2019. The decline in profits can be explained mainly by higher losses on loans, reflecting both heightened credit risk as a result of the pandemic and continued weak profitability in the offshore industry. The fact that the losses were not even higher must be viewed in light of the strong fiscal and monetary policy measures that have helped to dampen the pandemic's negative impact on the Norwegian economy. As a group, Norwegian banks were thus able to maintain relatively strong profitability, with a return on equity after three quarters of the year of 9.2 per cent (annualised).

Profits and return on equity in Norwegian banks

Source: Finanstilsynet

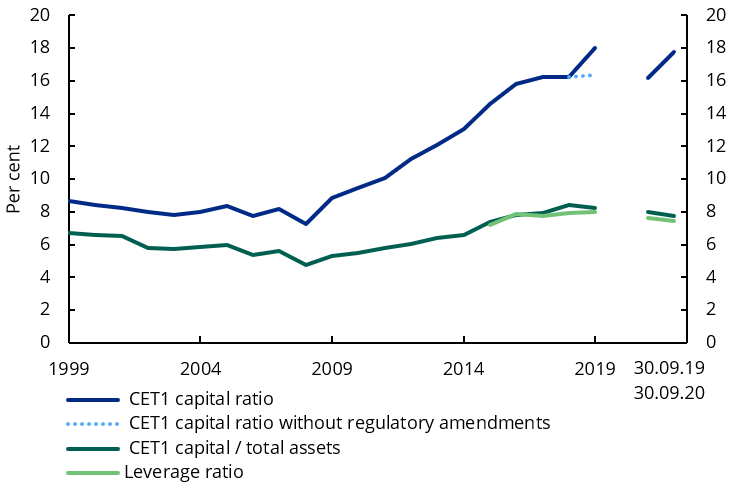

Capital adequacy requirements for banks were increased in the aftermath of the international financial crisis in 2008-2009. A strong performance in the period after the financial crisis has enabled Norwegian banks to improve their capital ratios, mainly through retained profits. The removal of the Basel 1 floor and the introduction of lower capital requirements for lending to small and medium-sized enterprises (‘SME supporting factor’) from 31 December 2019 as a result of the incorporation of the European capital adequacy framework (CRR/CRD IV) in Norwegian law led to an increase in the banks’ reported CET1 capital ratio of 1.5 percentage points, although their financial soundness remained unchanged. This helped Norwegian banks achieve an overall capital ratio that was well above the prevailing requirement at the beginning of 2020. This margin increased further after the Ministry of Finance lowered the countercyclical capital buffer from 2.5 to 1.0 per cent in March 2020 to avoid that a tightening of banks’ lending practices would amplify the downturn in the Norwegian economy. At end-September 2020, the banks' total CET1 capital ratio was 17.8 per cent, while the leverage ratio was 7.4 per cent. All the banks satisfied prevailing capital requirements. See further account in Risk Outlook December 2020.

Capital adequacy of Norwegian banks

Source: Finanstilsynet

Liquidity monitoring

Banks' funding mainly comprises deposits from customers and funding in the money and capital markets. Owing to a an increase in the share of long-term funding over several years, coupled with higher liquidity buffers, Norwegian banks were better equipped to face a tighter liquidity situation at the start of the pandemic. In early March 2020, the risk premiums on banks' bond funding increased to roughly the same level as during the global financial crisis in 2008, and there was limited access to new funding. Market conditions improved through the second and third quarter, partly as a result of extensive central bank measures. At end-September, risk premiums had almost returned to the level prior to the market turmoil in March, and the banks were able to obtain money and capital market funding the usual way.

Finanstilsynet is keeping a close watch on the financial institutions’ liquidity situation, including how they meet the minimum liquidity buffer requirement (LCR) and other liquidity and financing indicators. The institutions’ own assessments of liquidity and funding risk is also reviewed in connection with the supervisory assessment of risk and capital needs (SREP ) and at on-site inspections.

Follow-up of the Pillar 1 capital requirements

Pillar 1 sets out minimum and buffer requirements for own funds. Finanstilsynet follows up the Pillar 1 capital requirements in a number of areas. Among other things, Finanstilsynet each year advises the Ministry of Finance on which financial institutions should be considered systemically important in Norway, based on clear regulatory criteria. Systemically important institutions are subject to a buffer requirement of 1 or 2 per cent, depending on their size and their market share of lending to the private non-financial sector in Norway. In 2020, the Ministry of Finance defined DNB Bank ASA and Kommunalbanken AS as systemically important in Norway. Every quarter, Finanstilsynet presents its assessment of the level of countercyclical capital to the Ministry of Finance. Parallel to this, Norges Bank gives its advice regarding the buffer.

Finanstilsynet also provides guidance on how different parts of the regulations should be understood. In December 2020, Finanstilsynet published a circular (5/2020) on loans to be classified as high risk according to the standardised approach for credit risk. The circular gives a more detailed account of regulations based on the Capital Requirements Regulation and relevant guidelines and responses from the EBA. The follow-up of Pilar 1 capital requirements also encompasses banks' internal models for calculating capital requirements for credit risk (IRB models). Ten Norwegian institutions have permission to use such models. In order to obtain permission from Finanstilsynet, the institutions must document that the models are suited to measure risk, that they are used as part of the banks' risk management, credit approval process and internal and external reporting of risk, and that they are tested (validated) on a regular basis. Finanstilsynet considers these aspects when processing applications and when following up the institutions after permission has been granted. The follow-up takes place partly in the form of on-site inspections and partly as reviews of validation reports and capital requirements reports from the institutions. In 2020, Finanstilsynet carried out inspections at four of the IRB banks. Some of the banks have been required to include additional safety margins in their models, and others have been notified that they could be instructed to do so.

In 2020, Finanstilsynet started working on a circular on Finanstilsynet’s methodology for granting permissions and following up the banks' IRB models based on its experience with such models and new technical standards and guidelines from the EBA. This work was suspended when the pandemic broke out but was resumed towards the end of the year.

Follow-up of the Pillar 2 capital requirements – implementation of the supervisory review and evaluation process (SREP)

Finanstilsynet sets individual capital requirements for the institutions (Pillar 2 requirements). The Pillar 2 requirements cover risks that are not, or are only partially, covered under Pillar 1. The division of the institutions into groups according to size and risk profile determines how frequently the process should be carried out for the individual financial institutions. For the two systemically important institutions DNB Bank ASA and Kommunalbanken and institutions followed up by international supervisory colleges, Pillar 2 requirements are normally set each year.

In June 2020, Finanstilsynet decided that no Pillar 2 decision should be made in the second half of 2020 due to the prevailing situation. This decision was in accordance with the EBA's guideline on the pragmatic 2020 supervisory review and evaluation process in light of the Covid-19 crisis.

In the first half of 2020, Finanstilsynet made a total of 17 Pillar 2 decisions. The decisions are published consecutively on Finanstilsynet's website. The Pillar 2 requirements mainly reflect credit risk, concentration risk and market risk.

At the end of 2020, Pillar 2 requirements or capital requirements had been set as part of the licence terms and conditions for a total of 109 of the 151 relevant financial institutions. 29 of the 42 institutions that were not subject to such requirements had total assets below NOK 5 billion and a CET1 capital ratio that was minimum 6 percentage points above the prevailing minimum requirements and buffer requirements under Pillar 1. No individual capital requirements are normally set for these institutions as long as their capital adequacy level is maintained. Finanstilsynet plans to set Pillar 2 requirements for a number of the remaining institutions by the end of 2021.

Circular 12/2016 describes Finanstilsynet’s methodologies for assessing institutions’ risk and capital needs (SREP). In 2019, the authority published several new and updated appendices to the circular. The new appendices concerned Finanstilsynet’s use of stress tests in SREP and the Pillar 2 capital guidance (P2G). The circular is scheduled to be updated in the first half of 2021.

On-site inspections

At a so-called on-site inspection, Finanstilsynet makes a more thorough review of the risks facing an institution. The inspection is risk-based following an assessment of the institution’s size, risk areas and risk showing a negative deviation. After the inspection has been concluded, an inspection report is prepared. On-site inspections are an important means to uncover weak management and control or high levels of risk in the institutions. The dialogue with management and the board of directors provides the opportunity to guide and advise the institutions to enable necessary action to be taken at an early stage.

In 2020, Finanstilsynet conducted a total of 16 on-site inspections at banks, mortgage companies and finance companies and a total of five follow-up inspections addressing the banks' offshore exposure. The institutions’ lending activity remained the key area of supervision to enable early detection of heightened risk and shortcomings in terms of loss and write-down assessments and exposure follow-up. Follow-up of the credit area was particularly important in 2020, as banks' non-performing loans and the need for loss allowances had increased as a result of the Covid-19 pandemic.

In addition to the above-mentioned inspections, Finanstilsynet conducted three inspections related to ICT infrastructure, disaster recovery solutions and emergency preparedness in 2020, as well as four inspections related to the banks' internal models for calculating capital requirements for credit risk. In addition, eleven special inspections were carried out addressing measures against money laundering and terrorist financing.

As part of its supervisory activities, Finanstilsynet follows up sustainability and climate risk by including expectations regarding the institutions' handling of climate risk (physical risk and transition risk) in Finanstilsynet's tool (risk module) for evaluating the institutions' management and control. Climate risk was on the agenda at 15 of the 16 ordinary inspections at banks in 2020.

Read more

Systemically important institutions and institutions reviewed by supervisory colleges

Supervision of major banks operating in several countries in Europe is coordinated through supervisory colleges in which the relevant countries' supervisory authorities are represented. Finanstilsynet is the coordinating authority in the supervisory college for the DNB Group and has participated in supervisory colleges for six foreign financial institutions that operate in Norway through subsidiaries or branches. The work of the colleges follows guidelines set by the EBA.

The supervisory college for the DNB Group consists of, in addition to Finanstilsynet, the supervisory authorities in five of the countries where the Group is represented. The college focuses on preparing Joint Decisions on DNB's risk level and capital needs, liquidity and recovery plan. The Joint Decisions cover both the Group and its subsidiaries. In addition to the collaboration in the DNB College, Finanstilsynet maintains direct contact with the supervisory authorities of some of the other countries in which DNB operates. In the course of 2020, seven on-site inspections were conducted at DNB Bank ASA. In addition, an inspection was carried out at DNB Livsforsikring AS. Moreover, regular meetings are held with the Group's management and board chair, the statutory auditor and the internal auditor. There are also regular meetings with DNB related to, among other things, the bank's financial reporting, risk and regulatory compliance, as well as IT development. In addition, Finanstilsynet has assessed and commented on the bank's recovery plan.

In 2020, an on-site inspection was carried out at Kommunalbanken, focusing on the market and liquidity areas. An annual meeting was also held with Kommunalbanken’s board chair and management.

Finanstilsynet participates in the supervisory college for Bank Santander S.A. and conducted an IRB inspection at the bank in December 2020. In consequence of the Covid-19 pandemic, the college followed up the bank through regular meetings addressing operational risk, capital adequacy and credit risk. In addition, joint assessments of and decisions concerning the group's recovery plan were made in 2020.

In December 2019, Société Générale S.A. announced its intention to sell SG Finans AS to Nordea Abp. The company was incorporated into Nordea on 1 October 2020. Accordingly, Finanstilsynet is no longer a member of the supervisory college for Société Générale S.A.

Other large institutions

Every year, Finanstilsynet carries out comprehensive risk assessments of the other major banks in Norway (category 2 banks). Category 2 comprises large and medium-sized banks that mainly operate in the domestic market but have high market shares nationally or regionally. The risk assessments provide a basis for making inspection priorities and for assessing the banks' capital needs (SREP). In 2020, the group comprised 13 banks and banking groups. Four of the banks received their final SREP feedback in the course of 2020. Four ordinary inspections were also carried out among the category 2 banks during 2020. Three of the inspections focused on credit risk, and one addressed credit, market and liquidity risk. Climate risk was on the agenda at all inspections. Three follow-up inspections of banks' exposure to the oil and offshore industry were carried out among the category 2 banks. In addition, a special inspection on compliance with the money laundering legislation, two IRB inspections and one IT inspection were conducted among the banks in this group.

Other entities

In 2020, nine ordinary inspections were carried out at medium-sized banks (category 3) and small banks (category 4). Category 3 comprises other banks with total assets in excess of NOK 5 billion, as well as independent mortgage companies and finance companies with total assets in excess of NOK 5 billion. Category 4 comprises other institutions with total assets below NOK 5 billion. All the inspections addressed credit risk, market risk, liquidity risk and operational risk, as well as climate risk. Three special inspections concerning the institution’s AML work were also carried out, as well as one inspection relating to ICT among the small and medium-sized banks.

Systemically important branches

The EBA’s ‘Guidelines on supervision of significant-plus branches’ emphasise the need to broaden host country supervision of systemically important branches. Finanstilsynet regards the branches of Nordea Bank, Handelsbanken and Danske Bank as systemically important in Norway. Finanstilsynet therefore provides input to assessments of the groups' capital, liquidity and recovery plans under the auspices of the supervisory colleges for the three banks and makes annual assessments of the branches' significance for financial stability. In addition, Finanstilsynet participates in special colleges focusing on anti-money laundering efforts in Nordea and Danske Bank.

In 2020, one inspection was carried out on measures against money laundering and terrorist financing. Finanstilsynet also participated in regular meetings of the college to monitor the bank's risk situation in light of the Covid-19 pandemic. Furthermore, Finanstilsynet reviewed the bank's recovery plan and provided feedback on this.

As a result of the Covid-19 pandemic, regular information sharing and meetings took place in the supervisory college for Danske Bank and Handelsbanken through 2020. Finanstilsynet was also involved in assessments of banks' recovery plans. In addition, Finanstilsynet followed up on-site inspections conducted in 2019 on the anti-money laundering efforts of the two banks.

Follow-up of particular themes

Financial institutions' distribution of profits

As a result of the economic uncertainty surrounding the Covid-19 pandemic, Finanstilsynet and other European supervisory authorities have placed great emphasis on preserving the institutions’ financial soundness. The European Systemic Risk Board (ESRB) issued a recommendation to the relevant authorities in the EEA on 8 June 2020 to request banks and insurers to refrain from making dividend payments and share buy-backs at least until 1 January 2020.

The Ministry of Finance, which is the Norwegian macroprudential authority, notified the ESRB on 1 July 2020 that the Ministry will follow the recommendation. The Ministry clearly stated that it expects Norwegian banks and insurers to postpone the distribution of dividends, etc. until the great uncertainty attending economic developments has been reduced. In September, Finanstilsynet repeated its clear expectation that banks and insurers would refrain from distributing dividends etc. until 1 January 2021. Later in September 2020, the Ministry emphasised that it expected Norwegian banks to postpone dividend distributions or share buy-backs until the uncertainty has been further mitigated.

On 18 December 2020, the ESRB issued a new recommendation to national authorities to request banks and insurers to refrain from making dividend distributions, etc. until 30 September 2021, unless the institutions apply extreme caution and the distributions do not exceed the conservative thresholds set by the national supervisory authorities. In a letter sent to the Ministry of Finance on 21 December, Finanstilsynet gave its assessment of how the recommendation should be followed up in Norway. On 20 January 2021, the Ministry of Finance presented its assessment of how the ESRB's recommendation on dividends etc. should be implemented in Norway. The Ministry stated that banks should still apply caution in distributing profits in the coming months. Finanstilsynet expects Norwegian banks that, after making a prudent assessment based on the ESRB's recommendation, find that distributions are warranted, to limit total distributions to 30 per cent of cumulative annual profits for 2019 and 2020 up until 30 September 2021.

International accounting standards – IFRS 9

The international accounting standard IFRS 9 includes rules for impairment of loans. For entities issuing listed securities, the standard came into force on 1 January 2018. The Ministry of Finance decided in December 2018 that unlisted banks, mortgage companies and finance companies must apply IFRS 9 as of 1 January 2020. The change will ensure greater comparability between the financial statements of listed and unlisted entities.

In 2020, Finanstilsynet completed a thematic inspection of the implementation of the requirements regarding credit losses in IFRS 9 at nine banks, including two consumer loan banks. The purpose of the inspection was to chart how the banks employ the new IFRS 9 rules. During the inspection, the institutions' models and financial statements in selected areas described in IFRS 9 were reviewed. Inspection reports for each bank and a summary report were published on Finanstilsynet’s website on 18 August 2020. The summary report provides a resume of individual topics addressed during the thematic inspection, including a definition of default, underlying models and estimates, adjustment for forward-looking information, identification of loans with a significant increase in credit risk and disclosures. The report also describes the banks’ recognition of assets and companies repossessed from customers who have defaulted on their loans.

Banks' offshore exposure

Since 2016, Finanstilsynet has monitored the offshore exposure of a number of banks. The review in 2020 covered four banks, aiming to follow up developments in exposure and portfolio quality and the banks' level of impairment losses. At end-September 2020, the four banks’ total exposure amounted to approximately NOK 54 billion, which corresponds to about 4 per cent of the banks' total exposure to the corporate market.

Thus far, there has been limited scrapping of ships, and a large number of vessels remain laid up, causing a significant supply surplus. In Finanstilsynet’s opinion, there is still considerable downside risk to the banks' offshore portfolios.

New restructuring agreements have been entered into, and other restructuring processes are ongoing. A result of the new restructurings is that the banks are more likely than previously to convert debt into equity.

Recovery plans

As a preventive measure against solvency crises, all banks are required to draw up recovery plans indicating what steps can be taken to restore their financial position if it has weakened considerably. Finanstilsynet considers whether the banks’ recovery plans are of adequate quality and realistic.

The requirement for recovery plans is set out in Section 20-5 of the Financial Institutions Act and applies to all Norwegian banks, mortgage companies, parent companies and holding companies of financial groups as well as finance companies that are part of a financial group. The requirement also applies to certain investment firms. In June 2019, Finanstilsynet published a circular on recovery plans (circular 10/2019) describing Finanstilsynet's expectations as to the contents of the plan. According to the circular, small non-complex entities (SREP categories 3 and 4) may be subject to simplified recovery plan requirements provided that the entity is not considered to have functions of critical importance to society.

In 2020, Finanstilsynet reviewed and provided feedback on DNB’s recovery plans and on 30 recovery plans for banks in SREP categories 3 and 4. In addition, Finanstilsynet was involved in the supervisory colleges' assessment of the recovery plans of Danske Bank, Handelsbanken and Nordea.

Consumer lending

Lending volumes in the Norwegian consumer loan market have decreased substantially over the past year after several years of strong growth. The decrease was exacerbated during the Covid-19 pandemic.

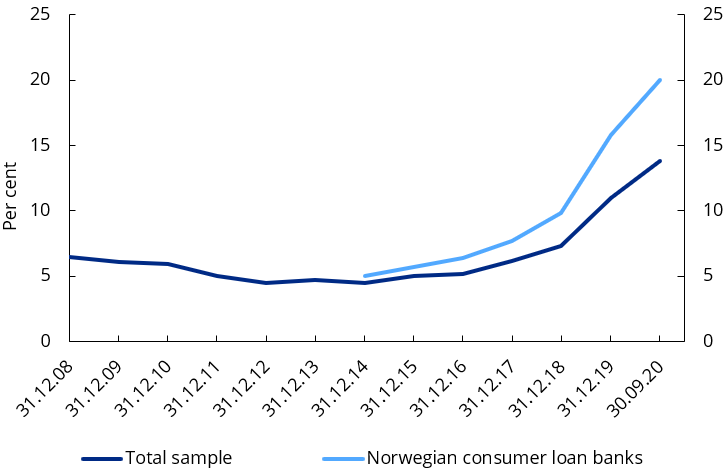

Finanstilsynet regularly runs a survey of a sample of 34 banks and finance companies offering consumer finance. The survey showed a 16.4 per cent reduction in consumer loans in the Norwegian market during the twelve months ending 30 September 2020 (see chart below). Adjusted for the sale of portfolios, there was a 13 per cent decrease in loan volume. In comparison, households' total debt increased by 4.7 per cent during the corresponding period.

Twelve-month growth in the Norwegian market for consumer loans and domestic household debt (C2)

Sources: Finanstilsynet and Statistics Norway (C2)

The share of non-performing consumer loans is considerably higher than for other types of loans. In recent years, there has been a marked increase in non-performing consumer loans both in NOK and as a share of total consumer loans (see chart below). At end-September 2020, 13.8 per cent of the consumer loans of the institutions in the selection were non-performing. Non-performing loans were up 2.8 percentage points compared with year-end 2019. At end-September 2020, non-performing loans at Norwegian consumer loan banks represented 20.0 per cent, up 4.2 percentage points compared with year-end 2019. In comparison, 1.1 per cent of all Norwegian banks' total loans were non-performing on the same date.

Share of non-performing consumer loans more than 90 days past due

* The figures refer to the institutions’ total consumer loans, including Norwegian institutions’ exposures abroad. Source: Finanstilsynet

In order to monitor banks' compliance with the regulations on requirements for financial institutions' lending practices for consumer loans (consumer loan regulations), Finanstilsynet also collects data on the use of the flexibility quota from 38 Norwegian banks, branches of foreign institutions and institutions engaged in cross-border activity in Norway. The proportion of granted loans that were in breach of one or more of the requirements of the consumer loan regulations was 2.7 per cent in the first quarter, 1.9 per cent in the second quarter and 2.2 per cent in the third quarter of 2020.

In the first quarter of 2020, three institutions exceeded the 5 per cent flexibility quota, while this was the case for one institution in the second quarter of the year and two institutions in the third quarter. In all three quarters, the loans were primarily in breach of the requirement for adequate debt servicing capacity. Finanstilsynet follows up entities that exceed the flexibility quota.

Residential mortgages

Every quarter, Finanstilsynet obtains reports on compliance with the residential mortgage lending regulations from 24 financial institutions and branches of foreign undertakings. The reports show the share of mortgages granted that do not meet the regulatory requirements on debt servicing capacity, debt-to-income (DTI) ratio, loan-to-value (LTV) ratio or instalment repayments.

The proportion of new loans secured on residential property in Oslo that were in breach of one or more of the requirements of the residential mortgage lending regulations was 5.9 per cent in the first quarter of 2020. This proportion increased to 8.6 per cent in the second quarter of 2020 and further to 11.5 per cent in the third quarter. During the first three quarters of 2020, failure to meet the requirement for maximum debt of five times income became an increasingly dominant reason why residential mortgages in Oslo are non-compliant.

In the first quarter of 2020, two institutions exceeded the 8 per cent flexibility quota for new residential mortgages in Oslo. In a letter to the relevant banks, Finanstilsynet emphasised the importance of the board taking the necessary measures and ensuring close follow-up. In the second and third quarter of 2020, no institutions exceeded the temporarily increased flexibility quota of 20 per cent, but eleven institutions exceeded the 8 per cent quota for new residential mortgages in Oslo in both quarters.

Outside Oslo, the share of new mortgages that failed to meet one or more of the requirements of the regulations was 7.1 per cent in the first quarter of 2020. This proportion increased to 8.1 per cent in the second quarter of 2020 and further to 8.6 per cent in the third quarter. These loans are primarily in breach of the requirement for a maximum debt-to-income (DTI) ratio, although it is not as predominant relative to weak debt servicing capacity and high loan-to-value (LTV) ratios as for new residential mortgages in Oslo.

One institution exceeded the 10 per cent flexibility quota for breach of one or more of the requirements for residential mortgages outside Oslo in the first quarter of 2020. In the second and third quarter of 2020, no institutions exceeded the temporarily increased flexibility quota of 20 per cent, but seven and eight institutions, respectively, exceeded the 10 per cent quota for breach of one or more of the requirements.

Residential mortgage lending survey

Finanstilsynet regularly examines banks' lending practices. In the autumn 2020 survey, 30 of the largest (Norwegian and foreign) banks reported data on close to 8 000 new instalment loans and 4 000 new lines of credit secured on residential property granted after 1 August 2020. The number of loans reported by each bank roughly corresponds to the banks' market share in the residential mortgage market.

The survey shows an increase in the overall DTI ratio among borrowers who have taken out new residential mortgages over the past few years. Although fewer borrowers have total debt exceeding five times gross annual income than before the DTI ratio was regulated in 2017, a far greater number of borrowers have total debt exceeding four times gross annual income (see chart below). In this year's survey, 45 per cent of total loans granted went to borrowers with total debt exceeding four times gross annual income.

Debt-to-income ratio* New instalment loans and lines of credit

*Maximum debt relative to income was not regulated until 1 January 2017.

Source: Finanstilsynet

Other relevant content

Licensing

Bank establishments

In June 2020, ESSB ASA was granted a licence to operate as a bank. The bank will be named Kystbanken, and the target group is small and medium-sized enterprises within seafood and shipping. The licence will not become valid until Finanstilsynet receives confirmation that the licence terms and conditions are met.

NordNorge Finans Forum ASA was granted a licence to operate as a bank in January 2019. As the licence terms and conditions were not fulfilled by the deadline, Finanstilsynet revoked the permission in February 2020.

Finance companies and mortgage companies

In March 2020, an application from Trustworthy Financial AS to operate as a mortgage company was rejected. The decision was appealed, and the appeal is under consideration by the Ministry of Finance.

Mergers and demergers

In December 2019, the DNB Group applied for permission to change the legal structure of the DNB Group, making DNB Bank ASA the parent company by merging DNB ASA with DNB Bank ASA. In July 2020, the Ministry of Finance granted the DNB Group permission to change the Group’s parent company. DNB subsequently sent an application for the other permits required to carry out the merger. The application is currently being considered by the Ministry of Finance. The merger is scheduled to be completed by July 2021.

In January 2020, Santander Consumer Bank AS was given permission to acquire 100 per cent of the shares in Forso Nordic AB and to expand the financial group. Forso was part of the Ford Group and offered credit to Nordic car dealers associated with the group and to the car dealers' customers. In Norway, Forso carried out financing activity in accordance with the exemption from the licencing obligation. Santander Consumer Bank was given permission to merge with Forso and to make a subsequent change to the group structure in May 2020. The merger was completed in November 2020.

In May 2020, Sparebank 68° Nord and Ofoten Sparebank were given permission to merge, with Sparebank 68° Nord as the acquiring bank. The merger was completed in September 2020.

In June 2020, Skue Sparebank and Hønefoss Sparebank were given permission to merge, with Skue Sparebank as the acquiring bank. The merger was completed in November 2020.

In July 2020, Easybank ASA, Fundu AS and BRAbank ASA were given permission to merge, with Easybank as the acquiring bank. The merger was completed in October 2020. The banks' operations have been continued under the name BRAbank.

In July 2020, Storebrand Bank ASA and Storebrand Finansiell Rådgivning AS were given permission to merge, with Storebrand Bank as the acquiring company. At the same time, Storebrand ASA was given permission to change its group structure as a result of the merger. The merger was completed in December 2020.

In November 2020, Helgeland Sparebank was given permission to acquire SpareBank 1 Nord-Norge's offices in Brønnøysund, Mo i Rana, Mosjøen and Sandnessjøen. In connection with the transaction, Helgeland Sparebank will join the SpareBank 1 alliance. In order to complete the transaction, Helgeland Sparebank will need additional funding and will carry out a public issue of up to NOK 800 million. The issue is pre-subscribed and underwritten by SpareBank 1 Nord-Norge and Sparebankstiftelsen Helgeland respectively. At the same time SpareBank 1 Nord-Norge was given permission to own up to 19.99 per cent of the equity certificates of Helgeland Sparebank after the issue. Furthermore, Helgeland Sparebank was given permission to own up to 15 per cent of Eiendomsmegler 1 Nord-Norge AS.

Recovery and resolution

In 2020, Finanstilsynet prepared resolution plans and set minimum requirements for own funds and eligible liabilities (MREL) for 14 banks, placing particular emphasis on the banks' management information systems and access to the financial infrastructure in a crisis situation. The banks were Bank Norwegian/Norwegian Finans Holding, DNB, OBOS-Banken/OBOS Finans Holding, Sbanken, Sparebanken Møre, Sparebanken Sogn og Fjordane, Sparebanken Øst, Sparebanken Sør, Sparebanken Vest, Sparebank 1 Møre, Sparebank 1 Nord-Norge, Sparebank 1 SR-Bank, Sparebank 1 SMN and Sparebank 1 Østlandet. Furthermore, Finanstilsynet considered a request from Finance Norway for postponement of the deadline for using debt instruments ranking below ordinary unsecured senior debt to meet the MREL requirement in light of the Covid-19 pandemic.

Finanstilsynet has headed the resolution college for the DNB Group and participated in the resolution colleges for six banks with extensive operations in Norway (Handelsbanken, Danske Bank, Nordea, Santander, Swedbank and Skandinaviska Enskilda Banken (SEB)).

Finanstilsynet has also refined a methodology for the calculation of levies in cooperation with the Norwegian Banks' Guarantee Fund and contributed to the International Monetary Fund's (IMF) ‘Financial Sector Assessment Program’ (FSAP) on financial safety nets.

Conversion of ownerless capital

In September 2020, SpareBank 1 Modum was given permission to convert NOK 250 000 000 of its ownerless capital into owners’ capital by issuing 2 500 000 equity certificates, each with a nominal value of NOK 100. At the same time, permission was given to establish Sparebankstiftelsen SpareBank 1 Modum, which at all times must hold equity certificates that equal or exceed 25 per cent of the total equity certificates.

Follow-up of reporting to debt information undertakings

In 2020, Finanstilsynet followed up the reporting of debt information to debt information undertakings and issued two orders regarding the reporting of debt information.

Name use

Finanstilsynet has assessed banks' name use in secondary trademarks/concept names and forwarded a complaint from Sparebanken Vest regarding ‘Bulder Bank’ to the Ministry of Finance. Finanstilsynet also followed up the name use of group institutions.

Changes in group structure

In November 2020, Storebrand ASA was given permission to change its group structure. The reason for the application was an agreement to transfer the shares in one of Storebrand Livsforsikring AS' subsidiaries, Euroben Life & Pension Designated Activity Company Limited, to the Swedish life insurer SPP Pension & Försäkring AB (publ). The latter is also a wholly-owned subsidiary of Storebrand Livsforsikring. The change was completed in November/December 2020.

Brexit

At the end of the transition period (1 January 2021), 68 UK credit institutions engaged in cross-border activity into Norway were listed in Finanstilsynet’s registry. At the end of the year, the registry was updated to reflect that UK credit institutions can no longer engage in cross-border activity into Norway. In order to carry on business in Norway, these institutions must establish a branch in Norway in accordance with Section 5-6 of the Financial Institutions Act or establish themselves in an EEA member state and then give notification of cross-border activity or establish a branch from there.

On 15 September 2020, DNB Bank ASA was given permission to retain its branch in the UK after the country's exit from the EU. The permission remains in force as long as the ‘Temporary permissions regime’ (TPR) applies in the UK. TPR means that the institution has temporary permission to operate in the UK until the post-Brexit legal situation has been clarified and the UK authorities have processed the application to establish a branch.

Read more

Other relevant information

Circular on fitness and propriety

In February 2020, Finanstilsynet published a new circular on fitness and propriety (circular 1/2020) which replaced circular 14/2015. The purpose was to clarify Finanstilsynet’s approach to fit and proper assessments for various types of institutions.

Circular on remuneration

In May 2020, Finanstilsynet published a new circular on remuneration in financial institutions and investment firms (circular 2/2020). This circular replaced circular 15/2014. The circular includes a description of new requirements, including provisions regarding notifications of/applications for exemptions from material risk taker status pursuant to Commission Delegated Regulation (EU) 604/2014. It is also emphasised that Finanstilsynet expects the institutions to ensure that remuneration, especially variable remuneration, is set at a conservative level in light of the Covid-19 pandemic.

Circular on outsourcing

Practically all institutions supervised by Finanstilsynet have entered into agreements on the outsourcing of parts of their operations. In October 2020, Finanstilsynet published a circular which was sent to all supervised institutions, and which replaced previous circulars on this subject. The circular provides guidance on what is considered to be outsourcing, restrictions on the right to enter into outsourcing arrangements and how supervised institutions must identify, assess and manage the risks associated with outsourcing. Furthermore, the circular gives guidance regarding Section 4c of the Financial Supervision Act on outsourcing and the obligation to notify Finanstilsynet.

Regulatory development

Implementation of the EU’s solvency framework

The EU's solvency framework comprises a directive that includes licensing requirements, rules on corporate governance and supervisory review (CRD IV) and a regulation on minimum own funds and liquidity coverage requirements (CRR). The framework is based primarily on the Basel Committee's capital and liquidity standards (Basel III).

EU regulations have largely been implemented in Norwegian law since 2014 but were fully incorporated in the EEA Agreement in 2019 and came into force in Norway on 31 December 2019. A number of regulations were then implemented in Norwegian law through incorporation provisions in the CRR/CRD IV regulations, replacing six regulations that were repealed as from the same date. Among other things, the new rules mean that loans to small and medium-sized enterprises will be subject to lower capital requirements than previously, and that the floor for risk-weighted assets for entities that are allowed to use internal risk models for capital requirements calculations has been removed. The new rules have enabled Norwegian banks to report higher capital adequacy ratios without this reflecting an actual improvement in their financial soundness.

In order to prevent a weakening of the sector’s financial strength, the Ministry of Finance decided to increase the systemic risk buffer rate to 4.5 per cent. The increase entered into force on 31 December 2020 for banks that use the advanced IRB approach to calculate credit risk or are defined as systemically important and will become effective on 31 December 2022 for all other institutions. The Ministry also decided to introduce risk weight floors for residential and commercial mortgages of 20 and 35 per cent, respectively, as from 31 December 2020. Both measures have been notified to the EU and EFTA and are under consideration. The Ministry will request the ESRB to recommend reciprocity for the measures.

In addition, Finanstilsynet chaired a working group that, on commission from the Ministry of Finance, prepared proposals for the implementation in Norway of changes to EU regulations for banks, the so-called banking package. The working group sent its report to the Ministry of Finance on 9 October 2020. The banking package implies changes to the CRD IV and CRR in addition to the Banking Recovery and Resolution Directive (BRRD). The working group's report also encompasses Regulation (EU) 2020/873 (the Covid-19 Regulation), which amends the EU’s Capital Requirements Regulation in response to the Covid-19 pandemic, thus easing certain requirements and advancing the application of previously adopted measures to ease the requirements.

As mentioned above, the implementation of CRR and CRD IV in Norwegian law entailed that the requirements to be met by Norwegian institutions were markedly reduced. The introduction of the banking package will result in a further easing of the requirements. While there will be a further reduction in the capital requirements for loans to small and medium-sized enterprises, the banking package does not include any buffer requirement for the leverage ratio for institutions that are not globally systemically important. However, it opens up for an additional leverage ratio requirement under Pillar 2.

Other key changes in the banking package include a revised framework for Pillar 2 and a new net stable funding ratio (NSFR) requirement. The new regulations must in principle be introduced without national adaptations, although there is scope for some national discretions. This applies, for example, to the proportion of banks that may be required to use a higher share of subordinated instruments (capital with a lower priority than ordinary senior bonds) to fulfil the MREL requirement, which entities are to be defined as small and non-complex, and which entities can be exempted from additional remuneration rules. The Ministry of Finance has circulated the working group’s proposal for comment with the deadline for response set at 6 January 2021. Finanstilsynet sent its response in a letter on 6 January 2021.

Treatment of problem loans

Regulation (EU) 2019/630 as regards minimum loss coverage for non-performing exposures requires a deduction from common equity Tier 1 capital for non-performing exposures that are not sufficiently covered by provisions. A proposal for implementation of the regulation has been circulated for comment with the deadline for response set at 31 January 2020.

In September 2020, on commission from the Ministry of Finance, Finanstilsynet gave supplementary advice on how to handle some of the consultation responses to the EU Regulation on non-performing exposures. Finanstilsynet pointed out that non-performing loans sold to finance companies are not necessarily excluded from the banking system and that the risk of arbitrage indicates that all types of finance companies should be subject to the same capital requirements as banks and mortgage companies.

Finanstilsynet further emphasised that Norwegian banks are financially sound and that it will take time before an increase in the deductions for non-performing loans materialise, as the rules only apply to loans originated as from 26 April 2019. Finanstilsynet thus found no reason to delay the implementation of the regulation on non-performing exposures on account of the Covid-19 pandemic. The matter is currently being considered by the Ministry of Finance.

Consultation document on access to confidential information from the National Population Register

On commission from the Ministry of Finance, Finanstilsynet prepared a consultation document regarding a legal basis for accessing confidential information in the National Population Register for mutual fund management companies, investment firms and financial institutions doing business in Norway on a cross-border basis. The consultation document was submitted in November 2020. Finanstilsynet proposes that a legal basis for such access is established for obliged entities pursuant to the Anti-Money Laundering Act, mutual fund management companies and investment firms, as well as branches of such undertakings.

New lending regulations

The previous residential mortgage lending regulations and consumer lending regulations expired on 31 December 2020. On 9 December 2020, the Ministry of Finance adopted regulations on financial institutions’ lending practices (lending regulations). The regulations entered into force on 1 January 2021 and will apply up to and including 31 December 2024. Finanstilsynet prepared the consultation document for the regulations.