Insurance and pensions

Last published: 29 March 2021

Regulation and supervision of the insurance and pension sectors are important in safeguarding customers’ rights under insurance and pension contracts, and in instilling public confidence in the insurance market. The supervisory regime aims to foster financially solid undertakings with sound risk management and internal control.

Facts about the insurance and pension industry

At the end of 2020, 12 life insurers, 52 non-life insurers (including 13 mutual fire insurance companies) and five mutual marine insurers were licensed to operate in Norway. A further 23 branches of foreign non-life insurers and seven branches of foreign life insurers were operating in Norway. Norwegian insurers had a total of 14 branches in other EEA states. One Norwegian life insurer and 19 Norwegian non-life insurers had notified cross-border activities to other EEA states. 64 foreign life insurers and 339 foreign non-life insurers had notified cross-border activities from other EEA states into Norway.

49 private pension funds, 35 municipal pension funds, one pension fund in run-off and one defined contribution pension undertaking were licensed to operate in Norway.

124 insurance intermediaries were listed in Finanstilsynet’s registry at the end of 2020: 65 insurance brokers, 13 of which also had a licence to operate as reinsurance brokers, one pure reinsurance broker, 41 insurance agents and 17 ancillary insurance intermediaries.

Developments

The Covid-19 pandemic had a negative impact on the undertakings’ profits in 2020. A large share of the total assets of life insurers and pension funds is invested in the securities markets. Market turmoil caused by the outbreak of Covid-19 in the first quarter of 2020 led to a sharp fall in stock markets, widening credit margins and a reduction in the risk-free interest rate. Although the markets largely recovered in the second and third quarter, the fall in equity prices had a negative impact on profits and was the main reason behind the decline in investment income for life insurers and pension funds compared with 2019.

Life insurers recorded an annualised adjusted return on the collective portfolio, which includes unrealised changes in value, of 2.5 per cent in the first three quarters of 2020. The annualised book return on the collective portfolio was 3.9 per cent. Pension funds’ annualised adjusted return on the collective portfolio was approximately 0 per cent in the first half of 2020, while the annualised book return was 2.4 per cent.

The risk-free market rate, represented by the 10-year Norwegian government bond yield, declined markedly in 2020 and was 1 per cent as at 30 December 2020. This is markedly lower than insurers’ and pension funds’ guaranteed rates of return, which were 2.6 and 2.5 per cent, respectively, at the end of 2019.

The low interest rate level, which is projected to persist, means that it will be more challenging for pension institutions to cover the guaranteed rate of return in defined benefit schemes. Although the proportion of defined contribution pension schemes is increasing strongly, contracts with an annual guaranteed return still represent the greater part of pension institutions’ liabilities.

The transitional measure for technical provisions means that the value of insurance obligations in part are calculated according to the former regulations, whereby the weighting of the former regulations will be gradually reduced during the transitional period, which extends until 2032. The transitional measure for technical provisions is of particular significance to undertakings with a large share of guaranteed liabilities. At end-September, the transitional measure was applied by and had effect for seven life insurers.

Developments in the 10-year government bond yield and average guaranteed rate of return

Sources: Finanstilsynet and Norges Bank

Overall, non-life insurers enjoy a sound level of profits and are not as affected by the Covid-19 crisis, although travel insurance has required extensive resources for case processing for some insurers and claims payments within this line of business have been higher than usual. However, travel insurance does not represent a dominant share of the obligations of any Norwegian insurers. In some other lines of business, claims payments appear to have been reduced somewhat as a result of lower economic activity. The level of profitability within, for example, motor vehicle insurance has improved significantly. It is unclear how profits from workers' compensation insurance will be affected by amendments to the regulations on occupational illness to include Covid-19 with severe complications as from 1 March 2020.

Non-life insurers were also hit by the stock market downturn in the first quarter of 2020. However, the recovery in the subsequent quarters and significant premium growth compared with 2019 ensured that the undertakings’ total profits for the first three quarters of the year were higher than for the corresponding period of 2019 (excluding Gjensidige's gain from the sale of Gjensidige Bank in 2019).

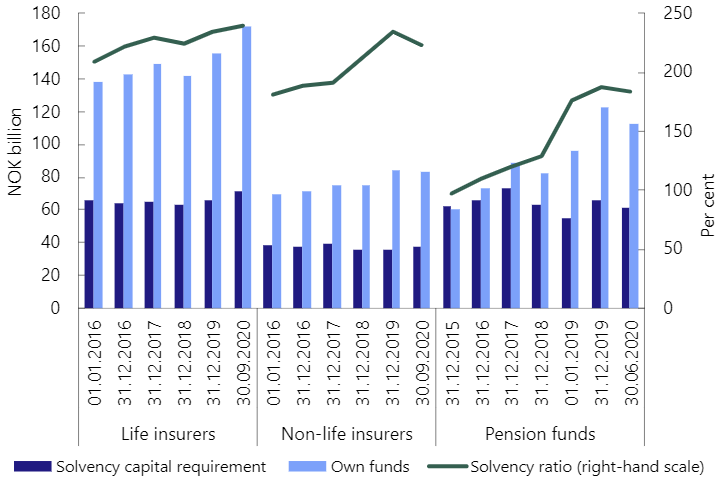

Solvency of insurers and pension funds

When applying the transitional measure for technical provisions, the solvency ratio of life insurers has risen since the Solvency II framework entered into force in 2016. All life insurers met the solvency capital requirement as at 30 September 2020. However, the interest rate decline in 2020 led to a sharp reduction in the solvency ratio when the transitional measure for technical provisions is not applied. The solvency ratio was 218 per cent at year-end 2019 and 173 per cent as at 30 September 2020.

Solvency of insurers and pension funds*

* Prior to 1 January 2019, there was no requirement for a solvency ratio above 100 per cent for pension funds.

A simplified solvency capital requirement, based on Finanstilsynet’s stress test, was introduced for pension funds from 1 January 2019. Some pension funds did not meet the solvency capital requirement during the market turmoil at the outbreak of the Covid-19 pandemic in the spring of 2020 but received capital injections or reduced their investment risk and were thus able to meet the requirement after a short period of time. At end-June 2020, pension funds’ combined solvency ratio was 184 per cent. All pension funds met the solvency capital requirement. Without the use of the transitional measure on technical provisions, the solvency ratio was 163 per cent.

In consequence of the Covid-19 pandemic and uncertainty about further market developments, all pension funds were asked in the spring of 2020 to report both key figures and the simplified solvency capital requirement as at 31 March 2020.

The Covid-19 pandemic

Reporting

In connection with the introduction of strict containment measures in Norway in March of 2020, extraordinary weekly reporting to Finanstilsynet from all life insurers and a selection of non-life insurers and pension funds was introduced. The reporting included information on the undertaking’s financial position, staff and emergency preparedness. The frequency was later changed to monthly reporting, before the extraordinary reporting was discontinued after the August reports had been submitted. The undertakings reported no significant problems related to ordinary operations.

Covid-19 with severe complications may entitle policyholders to workers’ compensation insurance

The regulations on occupational illness, which set forth which injuries and illnesses can be equated with occupational injuries, were amended with effect from 1 March 2020 as a result of the Covid-19 pandemic. The new rules primarily encompass employees in the health care system and entail that Covid-19 with severe complications may give the right to occupational injury compensation.

Dividend restrictions

As a result of the uncertainty surrounding the Covid-19 pandemic, Finanstilsynet and other European supervisory authorities have placed great emphasis on preserving the undertakings’ financial soundness. The European Systemic Risk Board (ESRB) issued a recommendation to the relevant authorities in the EEA on 8 June 2020 to request banks and insurers to refrain from making dividend payments and share buy-backs at least until 1 January 2021.

In September 2020, the Ministry of Finance stated that banks should refrain from dividend distributions until 1 January 2021 but pointed out that insurers to a greater extent should be able to base their distribution of profits on in-depth analyses of their financial strength. On 18 December 2020, the ESRB issued a new recommendation to national authorities to request banks and insurers to refrain from making dividend distributions, etc. until 30 September 2021, unless the institutions apply extreme caution and the distributions do not exceed the conservative thresholds set by the national supervisory authorities.

On 18 December, the European Prudential Regulation Authority (EIOPA) emphasised in its Financial Stability Report that uncertainty remains high, and it is key that insurers act to preserve their capital positions in balance. EIOPA also recommends insurers to maintain extreme caution and stresses that any dividend payments and other distributions should not exceed thresholds of prudency.

Finanstilsynet supports EIOPA's request that insurers adopt a cautious and prudent approach to profit distributions. This is especially relevant for life insurers with a large proportion of guaranteed liabilities, for whom low interest rates can make it more demanding to achieve sufficient returns. In a letter sent to the Ministry of Finance on 21 December 2020, Finanstilsynet gave its assessment of how the ESRB’s recommendation should be followed up in Norway. The Ministry of Finance responded to Finanstilsynet’s letter on 20 January 2021 but did not mention insurers specifically.

Read more

Supervision, monitoring and control

Monitoring and analyses

Finanstilsynet prepares quarterly reports on the profitability and balance sheet composition of life insurers and non-life insurers, while reports for pension funds are semi-annual. The 2020 results were published in the report on financial institutions' performance. The results were also included in Finanstilsynet’s semi-annual Risk Outlook report.

Each quarter, Finanstilsynet prepares an overall report on insurers’ solvency situation. A more comprehensive solvency report is drawn up annually. Finanstilsynet prepares semi-annual reports on pension funds’ solvency situation. These reports are public.

Other relevant information

Reporting from the institutions

Reports filed by the institutions are an important basis for analyses and on-site inspections.

In 2020, all insurers and pension funds reported accounting and statistical information to the financial databases ‘Forsikringsforetakenes offentlige regnskaps- og tilsynsrapportering’ (FORT) and ‘Pensjonskassenes offentlige regnskaps- og tilsynsrapportering’ (PORT). The reporting is a cooperative effort between Finanstilsynet and Statistics Norway.

All life and non-life insurers and pension funds whose total assets exceed NOK 1 billion also reported selected key figures to Finanstilsynet on a quarterly basis in 2020.

The solvency reporting according to Section 13-8 of the Financial Institutions Act and the Solvency II framework is based on fully harmonised EEA rules – Solvency II. The reporting requirements are wide-ranging and require substantial resources on the part of the institutions and Finanstilsynet alike. The reporting is used to follow up of the undertakings and is also forwarded to EIOPA. In 2020, the undertakings reported quarterly and annual figures for 2019.

The majority of the pension funds reported the simplified solvency capital requirement twice a year, while the nine largest pension funds reported quarterly. In addition, the pension funds annually report solvency margin requirements according to the Solvency I framework to Finanstilsynet. This is the European minimum harmonisation requirement.

As from the third quarter of 2019, new pan-European reporting was introduced for pension undertakings. The 23 largest Norwegian pension funds, covering over 75 per cent of the market, must report their balance sheet and list of assets to Finanstilsynet each quarter, in addition to the extended annual reporting. The reports are forwarded to EIOPA. With respect to other pension funds, Finanstilsynet annually sends aggregated information to EIOPA based on information in PORT and a separate, less comprehensive report for small pension undertakings.

On-site inspections

Finanstilsynet conducted on-site inspections at three life insurers in 2020. The inspections covered overall risk management, asset management operations and the calculation and validation of technical provisions and solvency capital requirements.

In 2020, Finanstilsynet conducted on-site inspections at two pension funds. The inspections reviewed the pension funds' management and control systems as well as their risk level and capitalisation.

Finanstilsynet conducted on-site inspections at six non-life insurers. These were ordinary inspections addressing the insurers' management and control systems as well as their risk level and capitalisation. In several of the undertakings, issues such as group affiliation and organisation were also key issues. Two of the inspections also encompassed the insurers' internal models for calculating capital requirements.

Finanstilsynet carried out one on-site inspection at an insurance agent in 2020. There were no on-site inspections at insurance brokers, but Finanstilsynet completed three supervisory processes initiated in 2019.

Read more

Supervisory cooperation

The supervision of large insurance undertakings operating in two or more countries through subsidiaries or large branches is coordinated through supervisory colleges in which the various countries’ supervisory authorities are represented. Finanstilsynet heads the supervisory college for Gjensidige Forsikring ASA and Storebrand ASA.

In 2020, Finanstilsynet participated in supervisory colleges for the following foreign insurance undertakings operating in Norway:

- Danica Pensjonsforsikring and Tryg Forsikring A/S (Denmark)

- If (Sampo) and Nordea Life and Pensions (Finland)

- Nordnet Livsforsikring AS (Sweden)

- Help Forsikring (Arag) (Germany)

Climate risk – insurers and pension funds

Both pension funds and non-life and life insurers are exposed to climate risk. Non-life insurers are directly exposed to physical climate risk due to the impact of climate change on their insurance portfolios. In addition, both their insurance portfolios and asset management operations are exposed to transition risk. Transition risk is risk associated with society's adaptation to climate change, including new regulations, new technology and changes in demand from investors and consumers. Life insurers and pension funds' exposure to climate risk is mainly related to asset management.

In an effort to increase the knowledge about climate risk in the insurance industry, meetings were held with three captives in 2020 to chart how they assess and manage climate risk. Captives insure the risks of entities in the group they are owned by. The groups are international players and thus may be subject to risk in countries other than Norway. The charting process is a continuation of a project that was initiated in 2019 and is still ongoing. In 2019, the climate risk management of three marine insurers was reviewed.

Climate risk was on the agenda at all inspections at insurers carried out in 2020. Finanstilsynet included the follow-up of sustainability and climate risk in its supervisory activities by including expectations regarding the insurers' handling of climate risk, both physical risk and transition risk, in Finanstilsynet's tool (risk module) for evaluating the insurers' management and control. The insurers also assessed climate risk in their annual report on their own risk and solvency assessment (ORSA), which was sent to Finanstilsynet. The review of insurers' assessment and management of climate risk will continue in 2021.

Through 2020, some work related to climate risk was also carried out in EIOPA, in which Finanstilsynet participates. Towards the end of 2020, EIOPA circulated a number of reports for comment.

On commission from the Ministry of Finance, Finanstilsynet has prepared a consultation document proposing a new Act on information about sustainability that encompasses a number of financial industry actors.

Read more

Licensing

Licence applications

In November 2018, Project Duo AS was given permission to operate as a non-life insurer. As the licence terms and conditions were not fulfilled by the deadline, Finanstilsynet revoked the permission in November 2020.

Mergers

In February 2020, the Ministry of Trade, Industry and Fisheries entered into an agreement to sell GIEK Kredittforsikring AS to the French credit insurer Compagnie Francaise d ́Assurance pour le Commerce Extérieur (COFACE). Finanstilsynet approved the application for the acquisition and subsequent merger in April 2020. GIEK Kredittforsikring AS will be a wholly owned subsidiary of COFACE until it is converted into a branch, which is scheduled to take place during the first quarter of 2021.

In September 2020, Finanstilsynet approved the merger between the mutual fire insurance companies Varig Forsikring Halsa og Tingvoll, Varig Forsikring Surnadal and Varig Forsikring Hemne, with Varig Forsikring Surnadal as the acquiring company. The merger will be completed in January 2021.

In September 2020, DNB Livsforsikring AS was granted permission to acquire all the shares in KLP Bedriftspensjon AS and then merge the entity with DNB Livsforsikring AS with DNB Livsforsikring as the acquiring company. The merger is scheduled for completion in the first quarter of 2021.

Portfolio transfer

In October 2020, Varig Forsikring Midt-Buskerud was given permission to transfer its insurance portfolio to Fremtind Forsikring AS. At the same time, permission was given to transfer the remaining operations of Varig Forsikring Midt-Buskerud to SpareBank 1 Modum and to liquidate the company. The liquidation has not been completed.

Extension of licence

In June and July 2020, the three mutual fire insurance companies Varig Forsikring Nordmøre og Romsdal, Varig Hadeland Forsikring and Varig Orkla Forsikring Gjensidig were given permission to extend their licence to apply to non-life insurance category 9 and to extend their geographic scope to apply throughout Norway. The undertakings have ended the cooperation with Gjensidige and have become part owners of the insurance group Frende Forsikring, which is owned by savings banks.

Internal models for calculating solvency capital requirements

The Solvency II framework permits insurers to use their own models to calculate the solvency capital requirement. Assuranceforeningen Gard – gjensidig and Gjensidige Forsikring ASA have permission to use internal models. An application from another company for the use of an internal model is currently under consideration by Finanstilsynet.

Revocation of insurance intermediary's licence

On 24 June 2020, Finanstilsynet decided to remove the insurance agent Tide Forsikring AS (Tide) from Finanstilsynet's registry. The reason for the decision was that repeated and serious violations of the general legislation for insurance intermediaries had been revealed at inspections, including key provisions on customer protection. Finanstilsynet therefore found that removing the agent from the registry was a necessary and proportionate response to safeguard the interests of potential future customers and the integrity of the market. Finanstilsynet’s decision has been appealed, and the appeal is under consideration by the Ministry of Finance. In a letter of 18 September 2020, the Ministry of Finance stated that the decision should not be implemented until the complaint has been finally settled.

Revocation of insurer’s licence

After an on-site inspection at Insr Insurance Group ASA (Insr) in 2019, Finanstilsynet concluded that there had been serious and persistent deficiencies in the insurer’s risk management and internal control system. Insr had also been subject to extraordinary reporting requirements for long periods as a result of its weak solvency position. In a letter to the undertaking on 26 June 2020, Finanstilsynet notified the undertaking that its licence to operate as a non-life insurer would be revoked. In its response, the undertaking had a number of legal and factual objections to the decision notified by Finanstilsynet. Nevertheless, Insr took note of Finanstilsynet’s notified conclusion, and its response included a plan for the liquidation of its insurance business. In a letter to Insr dated 11 September 2020, Finanstilsynet noted that the basic conditions for revoking the licence were in place. As the undertaking had presented a prudent plan for the liquidation of the business, however, it was not deemed necessary to make a revocation decision. It was assumed that the undertaking would follow the submitted plan, and Finanstilsynet now receives monthly updates from Insr. During the liquidation period, the undertaking is subject to the solvency capital requirements set out in Chapter 14.II of the Financial Institutions Act. According to the plan, the insurance business will be fully liquidated by the end of 2021.

Insurance intermediation by insurers that have gone bankrupt

In recent years, Finanstilsynet has followed up a number of insurance intermediaries that have mediated insurance for foreign insurers that have gone bankrupt. Among other things, Finanstilsynet has reviewed whether good mediation practice is observed, whether the intermediary adequately monitors the insurer’s solvency position and what information has been provided about guarantee schemes.

Mandatory occupational pension

Finanstilsynet oversees that entities which are required to have a mandatory occupational pension scheme fulfil this obligation. In 2020, Finanstilsynet considered a number of cases where no such pension scheme had been established. The supervision is mainly based on tips and enquiries from the tax authorities, employees and labour unions.

Release of premium reserves in public sector occupational pension schemes

As a result of the changes in public sector occupational pension schemes, significant premium reserves have been released. In a letter of 2 September 2020 to the pension institutions, Finanstilsynet stated that, pursuant to Section 4-8 of the Insurance Activities Act, the released funds must be added to the premium fund and cannot be used to reduce the rate of return in the contracts.

Non-Life Insurance Guarantee Scheme

Finanstilsynet acts as secretariat for the Non-Life Insurance Guarantee Scheme (the Guarantee Scheme). The purpose of the Guarantee Scheme is to prevent or reduce losses for private individuals and small and medium-sized enterprises if their insurer is unable to fulfil its obligations. The Guarantee Scheme is headed by a board of five members.

The Danish non-life insurer Alpha Insurance A/S went bankrupt on 8 May 2018. The board of the Guarantee Scheme has assumed that Norwegian policyholders are covered by the Danish Guarantee Fund for Non-life Insurers. However, Alpha policyholders who have entered into insurance contracts with Alpha's Norwegian branch will be entitled to advance compensation from the Norwegian Guarantee Scheme. The first payment from the Guarantee Scheme to cover claims against Alpha's Norwegian branch was made in December 2019. In 2020, the Guarantee Scheme made advance claims payments of NOK 5 million in a further 15 cases and will make payments on an ongoing basis as the bankruptcy administrators forward completed compensation cases.

Policyholders who have taken out insurance policies directly from Alpha in Denmark via insurance brokers are not entitled to coverage through the Norwegian Guarantee Scheme.

Complaints Board for Insurance and Reinsurance Brokerage Business

Finanstilsynet acts as secretariat for the Complaints Board for Insurance and Reinsurance Brokerage Business. The board handles disputes between clients and brokers. No complaints were referred to the board for decision in 2020.

Brexit

In 2019 and 2020, Finanstilsynet helped to prepare proposals for transitional rules in the insurance area in connection with the UK's exit from the EU. The proposals were circulated for comment by the Ministry of Justice and Public Security on 24 June 2020. Regulations on statutory insurance policies etc. taken out with a UK insurer and UK insurers’ right to provide insurance services etc. after the expiry of the transition period, entered into force on 1 January 2021. The regulations entail that insurance policies taken out with a UK insurer that was licensed to engage in insurance business in Norway prior to the end of the post-Brexit transition period, shall be deemed to be taken out in an EEA state until the end of the period of insurance or a date set by Finanstilsynet. Furthermore, the regulations entail that undertakings that were licensed to engage in insurance business prior to the end of the transition period based on a home country licence from the UK, can still carry out such business, apart from writing new policies, to customers in Norway without special permission from Finanstilsynet.

In 2020, Finanstilsynet followed up Norwegian non-life insurers and insurance intermediaries that have reported cross-border activity into the UK. Several Norwegian insurers that carry out business in the UK were well prepared to continue operating after the transition period. A number of Norwegian insurers and insurance intermediaries have applied to the UK authorities for permission to continue cross-border operations into the country under the Temporary Permissions Regime. Some insurers have applied for permission to establish a UK branch.

At the end of the transition period on 1 January 2021, 95 UK insurers engaged in cross-border activity into Norway were listed in Finanstilsynet’s registry. At the end of the 2020, the registry was updated to reflect that UK insurers can no longer engage in cross-border activity into Norway. In order to carry on business in Norway, these undertakings must establish a branch in Norway in accordance with Section 5-6 of the Financial Institutions Act or establish themselves in an EEA member state and thereafter report cross-border activity or establish a branch from there.

During the period the UK was a member of the EU, a number of UK insurance intermediaries reported cross-border activity into Norway. After the UK’s exit from the EU, insurance intermediaries based in the UK can only establish a branch in Norway upon permission from Finanstilsynet. Finanstilsynet has received no applications for such establishments from UK insurance intermediaries.

Read more

Other relevant information

Regulatory development

Temporary rules regarding furloughed employees in private occupational pension schemes

In connection with the Covid-19 pandemic, Finanstilsynet assisted the Ministry of Finance in the spring of 2020 in preparing temporary rules on furloughed employees in private occupational pension schemes. The rules were adopted in April 2020 and mean that employers may decide that furloughed employees who are supposed to be removed from the pension scheme can nevertheless continue as members of the scheme, although the accumulation of pension savings and their risk covers are discontinued. The rules aim to avoid extensive withdrawals from occupational pension schemes because firms furlough employees, and to avoid that a large number of pension schemes are wound up because firms do not have the financial ability to pay premiums and contributions to occupational pension schemes.

Regulations on rules for individual pension account

On 8 May 2020, the Ministry of Finance circulated for comment draft regulations to the Act on Individual Pension Account. In its response on 16 July 2020, Finanstilsynet generally supported the consultation document. It included a proposal for standardised compensation for asset management costs when an employee chooses a pension provider him/herself, a ban on differentiated prices for the management of current and former pension entitlements, and the need to retain historical data related to the pension capital certificates transferred to the individual pension account. In addition, Finanstilsynet commented on certain technical aspects in the consultation document.

Amendments to the Solvency II framework

The European Commission has adopted changes in supplementing rules to Solvency II. The rules were incorporated into the EEA Agreement and implemented in Norwegian law in the Solvency II Regulations and entered into force for Norwegian undertakings as from 30 June 2020. The amendments concern the rules for the solvency capital requirement and own funds. It has been established that the look-through approach should be applied to investments in associated property companies at solo level, whereby the capital requirement for these investments is calculated as property risk. Changes have also been made to the calibration of the capital requirement for premium and reserve risk within non-life insurance as well as catastrophe risk in non-life insurance and health insurance. Furthermore, the rules permit new methods for calculating capital requirements for investments in non-rated bonds and loans and for investments in unlisted equities. Comprehensive terms and conditions must be met if the undertakings choose to use these methods. In addition, the requirements for capital instruments eligible for inclusion in Tier 1 own funds have been changed, with stricter requirements for write-downs in case of non-compliance with the solvency capital requirement.

In December 2020, EIOPA submitted a proposal to the European Commission for more comprehensive amendments to the Solvency II framework. EIOPA’s proposal include higher capital requirements for interest rate risk, with a gradual phase-in over five years. If the regulations are changed in line with EIOPA's proposal, there will be a significant reduction in the solvency ratios of Norwegian life insurers.

Through membership on the EIOPA Board of Supervisors and subcommittees, Finanstilsynet, along with national financial supervisory authorities throughout the EEA, was involved in preparing for the new rules, including two impact studies.

Consultation document on the implementation in Norwegian law of provisions in the Solvency II Directive

On commission from the Ministry of Finance, Finanstilsynet submitted a consultation document on the implementation of the EEA rules corresponding to Articles 285-292 of the Solvency II Directive (2009/138/EC). These provisions concern the choice of law when reorganising and winding up insurers. Finanstilsynet proposes to implement the provisions by extending the scope of Chapter 21a of the Financial Institutions Regulations, which apply to credit institutions and some investments firms, to also include insurers.

Mandatory occupational pension – transfer of supervisory authority to the Norwegian Tax Administration

On 8 June 2020, the Ministry of Finance circulated for comment the Norwegian Tax Administration’s proposal to share income details reported to the Norwegian Tax Administration with suppliers of occupational pension schemes. It was also proposed to transfer supervisory authority pursuant to the Act on Mandatory Occupational Pensions from Finanstilsynet to the Tax Administration. The deadline for response was 20 July 2020. Finanstilsynet assisted in preparing the consultation document. The proposed legislation was passed on 21 December 2020. The provisions will simplify employers’ reporting obligation as it will no longer be necessary to report the same information to both the pension institutions and the Tax Administration. It has also been decided that employers must report who they have entered into occupational pension agreements with. The Tax Administration will take over the responsibility of supervising employers’ compliance with the Act on Mandatory Occupational Pensions as from 1 June 2021. The other legislative amendments entered into force in Norway on 1 January 2021.