Insurance and pensions

Last published: 31 March 2022

Regulation and supervision of the insurance and pension sectors are important in safeguarding customers’ rights under insurance and pension contracts, and in instilling public confidence in the insurance market. The supervisory activities should help ensure that the undertakings are financially sound and safeguard customers’ rights and interests.

Facts about the insurance and pension industry

At the end of 2021, eleven life insurers, 51 non-life insurers (including nine mutual fire insurance companies) and five mutual marine insurers were licensed to operate in Norway. A further eight branches of foreign life insurers and 24 branches of foreign non-life insurers were operating in Norway. Norwegian non-life insurers had a total of twelve branches in other EEA states and four branches in countries outside the EEA. One Norwegian life insurer and 19 Norwegian non-life insurers had notified cross-border activities to other EEA states. 65 foreign life insurers and 411 foreign non-life insurers had notified cross-border activities from other EEA states into Norway.

48 private pension funds, 34 municipal pension funds, one pension fund in run-off and one defined-contribution pension undertaking were licensed to operate in Norway.

138 insurance intermediaries were listed in Finanstilsynet’s registry at the end of 2021: 65 insurance brokers, 13 of which also had a licence to operate as reinsurance brokers, one pure reinsurance broker, 45 insurance agents and 27 ancillary insurance intermediaries.

Developments

Life insurance and pensions

The financial performance of life insurers and pension funds largely reflects financial market developments. The stock market recovery in 2021 gave a boost to pension institutions’ returns and profits compared with 2020, which was characterised by a significant fall in equity prices following the outbreak of the Covid-19 pandemic. The adjusted return on the pension institutions' collective portfolios in the first three quarters of 2021 was slightly lower than in 2019, the year before the onset of the pandemic. However, the return on life insurers’ unit-linked portfolios was somewhat higher.

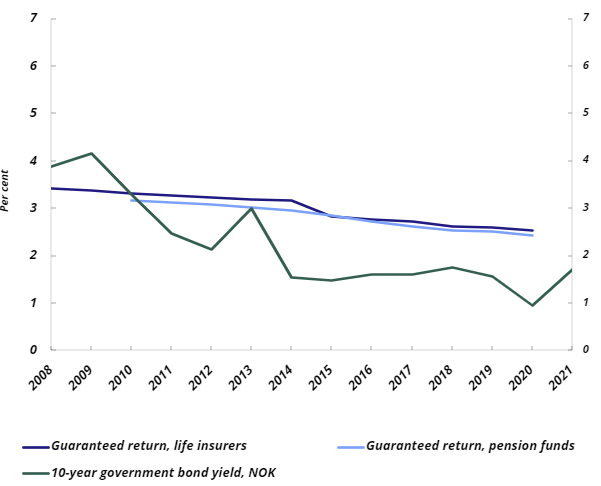

Developments in the 10-year government bond yield and average guaranteed rate of return

Sources: Finanstilsynet and Refinitiv

In 2020, the risk-free market rate, represented by the 10-year Norwegian government bond yield, declined from an already low level. The yield picked up slightly towards the end of the year and increased through 2021. In December, however, increased uncertainty about the flare-up of the pandemic led to a decrease in the long-term yield to 1.72 per cent as at 31 December 2021, cf. the above chart. The level is still considerably lower than the average guaranteed rate of return in pension institutions’ defined-benefit pension schemes.

Non-life insurers

With the exception of the first quarter of 2020, the Covid-19 pandemic has had a limited negative effect on non-life insurers' financial performance. In lines of business where the claims frequency is affected by the level of economic activity, such as motor vehicle insurance, profitability has improved as a result of less travel during the pandemic. Overall, this has helped to raise profits from insurance operations, and non-life insurers recorded an unusually strong overall insurance result in the first three quarters of 2021. Financial market developments have also contributed to the strong performance of non-life insurers.

Supervision, monitoring and control

Reporting from the undertakings

The undertakings' reporting constitutes an important basis for analyses of individual undertakings and markets, risk assessments and supervisory follow-up.

Just like in previous years, all insurers and pension funds reported accounting and statistical information to the financial databases ‘Forsikringsforetakenes offentlige regnskaps- og tilsynsrapportering’ (FORT) and ‘Pensjonskassenes offentlige regnskaps- og tilsynsrapportering’ (PORT) in 2021. The reporting is a cooperative effort between Finanstilsynet and Statistics Norway.

All life and non-life insurers also reported selected key figures to Finanstilsynet on a quarterly basis in 2021. Pension funds whose total assets exceed NOK 1 billion also reported selected key figures to Finanstilsynet twice a year.

The solvency reporting for insurers is based on pan-European rules – Solvency II. The requirements are wide-ranging and require substantial resources on the part of the undertakings and Finanstilsynet alike. The reporting is used for supervisory follow-up of the undertakings and is also forwarded to the European Insurance and Occupational Pensions Authority – EIOPA. In 2021, Finanstilsynet received reports from the undertakings at year-end 2020 and for each of the first three quarters of 2021.

The majority of the pension funds reported the simplified solvency capital requirement as at 30 June, while the nine largest pension funds reported each quarter. In addition, the pension funds reported solvency margin requirements to Finanstilsynet as at 31 December 2020. This is the European minimum harmonisation requirement according to the Solvency I framework.

The 23 largest Norwegian pension funds, covering over 75 per cent of the market, reported their balance sheet and a list of assets to Finanstilsynet each quarter in 2021, in addition to an extended annual reporting for 2020. This is in accordance with pan-European reporting requirements for pension undertakings. Finanstilsynet forwarded the reports to EIOPA. For the other pension funds, Finanstilsynet has sent aggregate information as at 31 December 2020 to EIOPA. This information is based on information in PORT and separate, less comprehensive reporting from the small pension undertakings.

Monitoring and analyses

Based on reporting from the undertakings, Finanstilsynet prepares quarterly reports on the profitability and balance sheet composition of life insurers and non-life insurers, while reports for pension funds are prepared twice a year. The results for 2020 were published in the report on financial institutions’ performance (in Norwegian only) in February 2021 and also formed the basis for analysis in Finanstilsynet’s semi-annual Risk Outlook report.

Finanstilsynet prepared a quarterly summary report on insurers’ solvency situation. In addition, a more comprehensive report on the solvency situation at year-end 2020 was prepared. Finanstilsynet prepared semi-annual reports on pension funds’ solvency. All the reports were published on Finanstilsynet’s website.

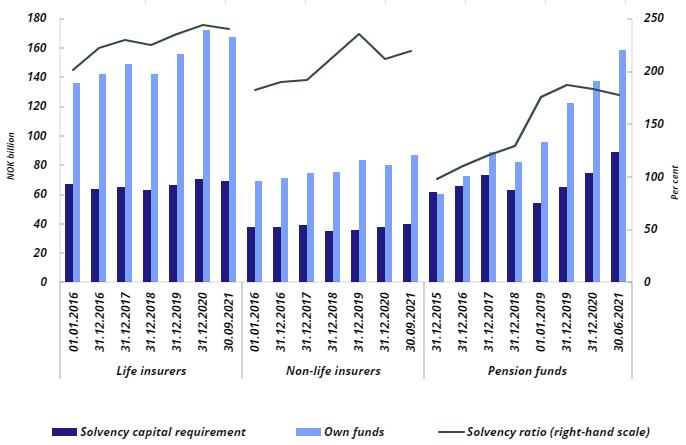

More about the solvency of insurers and pension funds

When applying the transitional measure for technical provisions, the solvency ratio of life insurers has risen since the Solvency II framework entered into force in 2016. Life insurers’ solvency ratio was 240 per cent as at 30 September 2021, which is somewhat higher than before the pandemic (as at 31 December 2019). Without the use of the transitional measure on technical provisions, the solvency ratio was 222 per cent. The solvency ratio of non-life insurers combined decreased somewhat in 2020, partly on account of dividend payments but widened in the first three quarters of 2021, standing at 220 per cent as at 30 September 2021.

A simplified solvency capital requirement, based on Finanstilsynet’s stress test, was introduced for pension funds from 1 January 2019. Pension funds’ solvency ratio has contracted somewhat during the pandemic, standing at 178 per cent as at 30 June 2021. Without the use of the transitional measure on technical provisions, the solvency ratio was 172 per cent on the same date.

Solvency position of insurers and pension funds*

* Prior to 1 January 2019, there was no requirement for a solvency ratio above 100 per cent for pension funds.

In 2021, EIOPA conducted a stress test of 44 European insurance groups, including Gjensidige Forsikring ASA, KLP and Storebrand ASA. The stress test addressed the consequences of a negative scenario on the solvency and liquidity of the participating groups. Finanstilsynet was responsible for carrying out the stress test in Norway.

Relevant information at finanstilsynet.no

On-site inspections

During an on-site inspection, the undertaking’s management and control system, including strategies and guidelines, organisation, monitoring and reporting, is reviewed, along with the undertaking’s risk level and capitalisation. Some on-site inspections also focus on specific themes or risk areas. After an on-site inspection, the undertaking receives an inspection report.

On-site inspections are primarily a preventive supervisory activity. The dialogue with management and the board of directors provides the opportunity to guide and advise the undertakings to enable necessary action to be taken at an early stage. Some inspections were carried out digitally in 2021 as a result of the authorities' containment measures.

Finanstilsynet conducted on-site inspections at three life insurers in 2021. The inspections addressed overall management and control, asset management, insurance operations, information and advisory services and the calculation and validation of technical provisions and capital requirements. At one of the inspections, there was special focus on ICT after the undertaking had implemented an extensive ICT change project.

Finanstilsynet conducted on-site inspections at two pension funds in 2021. At the inspections, the pension funds' management and control systems as well as their risk level and capitalisation were reviewed.

In addition, an on-site inspection was carried out at a defined-contribution pension undertaking, focusing on customer protection.

On-site inspections were conducted at six non-life insurers in 2021. These were ordinary inspections addressing the insurers' management and control systems as well as their risk level and capitalisation. Key themes at several of the inspections were the role and competencies of the board of directors, approval procedures for new products, the independence of control functions, external and intra-group outsourcing, as well as distribution models.

Finanstilsynet carried out one inspection at an insurance agent in 2021 and one inspection at an insurance broker in 2021. The purpose of the inspections was to review the undertakings’ management and control system.

Supervisory cooperation

The supervision of large insurance undertakings operating in two or more countries through subsidiaries or large branches is coordinated through supervisory colleges in which the various countries’ supervisory authorities are represented. Finanstilsynet heads the supervisory college for Gjensidige Forsikring ASA and Storebrand ASA.

In 2021, Finanstilsynet also participated in supervisory colleges for the following foreign insurance undertakings operating in Norway:

- Danica Pensjonsforsikring and Tryg Forsikring A/S (Denmark)

- If (Sampo) and Nordea Life and Pensions (Finland)

- Nordnet Livsforsikring AS (Sweden)

- Help Forsikring (Arag) (Germany)

Climate risk at insurers and pension funds

Insurers and pension funds are exposed to climate risk. Non-life insurers are directly exposed to physical climate risk in their insurance portfolios, for example due to changes in precipitation and wind conditions. In addition, both their insurance portfolios and asset management operations are exposed to transition risk. Transition risk is risk associated with society's adaptation to climate change, including new regulations, new technology and changes in demand from investors and consumers. Life insurers and pension funds' exposure to climate risk is mainly related to asset management.

Over the past couple of years, Finanstilsynet has held meetings with a total of 15 non-life insurers where climate risk has been on the agenda. The purpose of the meetings has been to identify how climate change may affect non-life insurers' risk, how such risk will affect them and how they manage the risk. In 2021, meetings were held with three ordinary non-life insurers, three non-life insurers that are part of a group and three marine insurers.

Climate risk was on the agenda at all inspections at insurers in 2021.

Finanstilsynet has included expectations regarding the insurers' handling of climate risk, both physical risk and transition risk, in Finanstilsynet's tool (risk module) for evaluating the insurers' management and control. The insurers also assessed climate risk in their annual report on their own risk and solvency assessment (ORSA), which was sent to Finanstilsynet. The review of insurers' assessment and management of climate risk will continue in 2022.

In a report on insurers’ climate risk published in March 2021, Finanstilsynet focuses on the insurers’ climate risk exposure through securities market investments. Calculations show that Norwegian insurers generally have well-diversified securities portfolios. The share of climate-sensitive investments in Norwegian life and non-life insurers’ equity and bond portfolios is on a par with the average for European insurers. A significant proportion of Norwegian insurers’ climate-sensitive investments are within renewable energy. However, the exposure of some Norwegian insurers is considerably higher than average.

Through 2021, work related to climate risk was also carried out in EIOPA, in which Finanstilsynet participates. In July 2021, EIOPA published a methodological paper assessing how the risk of climate change may be included in calculations of capital requirements for catastrophe risk.

Read more in the reports from the supervised sectors for 2021 about

Licensing

Branches and cross-border activities

During 2021, three foreign insurers established branches in Norway. These are Norli Pension Livsforsikring AB, headquartered in Denmark; Compagnie Francaise d'Assurance Pour Le Commerce Extérieur S.A, headquartered in France; and Youplus Assurance AG, headquartered in Liechtenstein. Several insurers have notified cross-border activity into Norway directly from another EEA state. During 2021, Finanstilsynet received some enquiries and questions relating to Brexit, primarily regarding operations in Norway after the end of the transition period.

Complaints Board for Insurance and Reinsurance Brokerage Business

Finanstilsynet acts as secretariat for the Complaints Board for Insurance and Reinsurance Brokerage Business. The board handles disputes between clients and brokers. No complaints were referred to the board for decision in 2021.

Business unrelated to insurance

In 2021, Finanstilsynet considered whether insurers can own undertakings that issue tags for road toll. Insurers cannot carry on business other than insurance operations, unless such business has ‘a natural connection to the business encompassed by its licence’. This follows from the Financial Institutions Act. The prohibition against carrying on other business also includes business conducted through subsidiaries. This is referred to as a prohibition against engaging in business unrelated to insurance. Finanstilsynet is of the opinion that the issue of tags for road toll, whether it is conducted by the undertaking itself or by a subsidiary, represents business unrelated to insurance. The matter is now under consideration by the Ministry of Finance.

Revocation of insurer’s licence

After Finanstilsynet notified revocation of Insr Insurance Group (Insr) ASA's licence to conduct non-life insurance operations in June 2020, Finanstilsynet accepted, in a letter dated 15 September 2020, the liquidation plan presented by the insurer. The premise was that all insurance obligations would be off Insr's books by the end of 2021. Finanstilsynet has monitored the liquidation of the insurance business through monthly reports and meetings with the insurer. There have been delays in the process to negotiate agreements on the sale of portfolios and a reinsurance agreement. After Finanstilsynet gave its permission in January 2022 for the transfer of the insurer’s outstanding insurance portfolio to DARAG Deutschland AG, it has been decided to revoke Insr's licence to carry on insurance business. The decision to revoke the licence enters into force subject to specific terms and conditions, including a confirmation from the statutory auditor that the insurer’s insurance risk has been eliminated.

Discontinuation of insurance intermediation in Denmark

Directive (EU) 2016/97 on insurance distribution (IDD) entered into force in the EU in 2018 but has thus far not been implemented in Norwegian law. In December 2021, however, the Storting (Norwegian parliament) adopted a new Act on insurance intermediation which came into force on 1 January 2022. The Act implements the IDD in Norwegian law. According to the IDD, insurance intermediaries retain their right to conduct business throughout the EEA on the basis of their home state licence after notifying the host state. In summer 2021, the Danish Financial Supervisory Authority stated that Danish legislation only allows notifications of cross-border activity under the current IDD rules. This meant that Norwegian insurance intermediaries’ operations in Denmark had to be discontinued until the IDD was implemented in Norwegian law.

Internal models for calculating solvency capital requirements

The Solvency II framework permits insurers to use their own models to calculate the solvency capital requirement. Assuranceforeningen Gard – gjensidig and Gjensidige Forsikring ASA have permission to use internal models. An application from another company for the use of an internal model is currently under consideration by Finanstilsynet.

Non-Life Insurance Guarantee Scheme

Finanstilsynet acts as secretariat for the Non-Life Insurance Guarantee Scheme (the Guarantee Scheme). The purpose of the Guarantee Scheme is to prevent or reduce losses for private individuals and small and medium-sized enterprises if their insurer is unable to fulfil its obligations. The Guarantee Scheme is headed by a board of five members.

The Danish non-life insurer Alpha Insurance A/S went bankrupt on 8 May 2018. The board of the Guarantee Scheme has assumed that Norwegian policyholders are covered by the Danish Guarantee Fund for Non-life Insurers. Alpha policyholders who have entered into insurance contracts with Alpha's Norwegian branch will be entitled to advance compensation from the Norwegian Guarantee Scheme. The Guarantee Scheme brought a lawsuit against the Guarantee Fund to verify that the Guarantee Fund has principal responsibility. The Court of Appeal of Eastern Denmark (Østre Landsret) in Copenhagen delivered its judgment on 22 December 2021. The Guarantee Fund for Non-life Insurers was acquitted as the court concluded that the Norwegian occupational injury insurance scheme does not qualify as liability insurance. The board of the Guarantee Scheme has decided to appeal the decision.

The first payment from the Guarantee Scheme to cover claims against Alpha's Norwegian branch was made in December 2019. The Guarantee Scheme made advance compensation payments of approximately NOK 5 million in another 15 cases in 2020 and advanced approximately NOK 1.6 million in 12 cases in 2021. The Guarantee Scheme will continue to make advance compensation payments as and when the bankruptcy administrators forward completed compensation cases.

Policyholders who have taken out insurance policies directly from Alpha in Denmark via insurance brokers are not entitled to coverage through the Norwegian Guarantee Scheme.

Mandatory occupational pension

On 1 June 2021, the Norwegian Tax Administration took over responsibility for supervising that employers establish pension schemes for their employees. Finanstilsynet has previously been responsible for such supervision.

Amendments to articles of association

In May 2021, Finanstilsynet approved amendments to Gjensidigestiftelsen’s articles of association, whereafter its ownership interest in Gjensidige Forsikring ASA shall be minimum 33.4 per cent of issued shares. In connection with the conversion of Gjensidige to a public limited liability company, the Ministry of Finance set a condition for Gjensidigestiftelsen's percentage ownership interest in the company. In May 2021, this condition was changed by Finanstilsynet to ensure alignment with the approved amendments to Gjensidigestiftelsen’s articles of association.

Changes in group structure

In September 2021, Storebrand ASA was granted permission to change its group structure in connection with the acquisition of Capital Investment A/S and CI AM ApS. The acquisition was completed in September 2021.

Liquidations

In February 2021, Moss municipality was granted permission to liquidate its pension fund, which was deleted from Finanstilsynet’s registry in March 2021.

In December 2021, CHC Norge was granted permission to liquidate its pension fund, which was deleted from Finanstilsynet’s registry in the course of the same month.

Regulatory development

Flexible use of surplus returns on guaranteed pension products

In Proposition 223 L (2020-2021) on changes in pension legislation, etc. (pension from

the first krone and day for guaranteed pension products), the Ministry of Finance has proposed that the Act on Insurance Activity should provide legal authority in regulations for allowing more flexible use of surplus returns for guaranteed pension products. The draft legislation was passed by the Storting in December 2021.

On commission from the Ministry of Finance, Finanstilsynet has prepared a consultation document proposing regulations with a legal basis in the proposed new provision. In the consultation document, Finanstilsynet proposed that pension providers should be allowed to allocate different percentages of the premium reserve to supplementary provisions for groups of contracts based on the need to build up supplementary provisions for the individual contracts. Finanstilsynet further proposed that the factors to be taken into account by the pension providers when availing themselves of the right to use different percentages, should be set out in regulations. According to the proposal, the pension provider should factor in the contracts' calculation rate level, the existing supplementary provisions allocated to the contracts, the level of other buffers relating to assets in the collective portfolio, the remaining term of the contracts and other relevant aspects. Finanstilsynet further proposed that the allocation of the supplementary provisions should be designed to avert unreasonable differential treatment and conflicts of interest between clients and client groups or between clients and the undertaking.

Implementation of the Pan-European Personal Pension Product Regulation (PEPP)

The Regulation on a Pan-European Personal Pension Product (PEPP Regulation) was adopted in the EU in 2019 and will start to apply in the EU on 22 March 2022. The regulation is part of the European Commission's work to facilitate the creation of a capital markets union. The pension product regulated by the regulation will be a personal, non-labour market related pension savings product that is acquired voluntarily by a natural person for long-term saving for retirement. The product will complement existing government and private pension schemes and are not intended to replace or harmonise existing national individual pension savings schemes. According to the regulation, no one is required to offer the PEPP product, but only products registered under the rules of the regulation can be marketed and distributed in the EU under the designation ‘PEPP’.

Finanstilsynet has been commissioned by the Ministry of Finance to prepare a draft consultation document proposing how the provisions of the PEPP regulation can be implemented in Norwegian law.

New Insurance Intermediation Act and amendments to the Financial Institutions Act

In December 2021, the Storting adopted a new Act on insurance intermediation and amendments to the Financial Institutions Act. In addition, the Ministry of Finance adopted new regulations on insurance intermediation and amendments to the Financial Institutions Regulations. The legislation came into force on 1 January 2022 and implements pan-European rules on insurance distribution, Directive (EU) 2016/97, Insurance Distribution Directive (IDD).

In 2021, Finanstilsynet prepared a consultation document with draft regulations to the Insurance Intermediation Act and the Financial Institutions Act. The consultation document was based on Finanstilsynet’s consultation document on the implementation of the IDD in Norwegian law and on the proposition concerning the legislative amendments that have now been enacted.

New rules have been adopted on, among other things, the registration of insurance agents in Finanstilsynet's registry, requirements for the financial performance of insurance intermediaries, fit and proper assessments in insurance undertakings, continuing education requirements and the handling of conflicts of interest. Furthermore, special conditions have been introduced for the receipt of benefits from parties other than the customer, as well as new rules on product governance.

Relevant information at finanstilsynet.no

Pension institutions’ treatment of management fees for assets placed in mutual funds

In a number of inspection reports issued after on-site inspections at life insurers and pension funds, Finanstilsynet states that the management fees incurred when a pension institution's policyholders’ funds are invested in mutual funds, shall be regarded as management costs that, according to the Act on Insurance Activity, shall be covered by the undertaking’s price for managing assets. In Finanstilsynet’s opinion, costs related to asset management should be calculated, clearly stated and pre-paid through the advance premium payments required under the Act. Finanstilsynet accounted for the basis for its understanding of the law in an identical letter to the pension institutions on 7 April 2021. The trade associations are of the opinion that the interpretation of the law set out in Finanstilsynet’s letter is incorrect and have asked the Ministry of Finance to consider Finanstilsynet’s interpretation. The trade associations' enquiry is under consideration by the Ministry of Finance.

New financial reporting standard on insurance contracts (IFRS 17)

With effect from 2023, a new international financial reporting standard for insurance contracts will be introduced – IFRS 17. The EU approved the standard in December 2021. IFRS 17 shall be used for consolidated financial statements prepared in accordance with IFRS. It will be up to national authorities to decide whether the standard should also be applicable to statutory accounts.

On 1 June 2021, the Ministry of Finance circulated for comment Finanstilsynet’s consultation document on the application of IFRS 17 for the statutory accounts. In the consultation document, Finanstilsynet proposes that life insurers should not be allowed to apply IFRS 17 until further notice. Finanstilsynet further proposes that large non-life insurers should be under an obligation to apply IFRS 17, while medium-sized and small non-life insurers should be able to choose whether to use IFRS 17 or current rules. At year-end 2021, the proposal was under consideration by the Ministry of Finance after the end of the consultation period.

Measurement of financial assets in policyholders’ accounts

Under current rules, financial assets in pension providers' policyholders’ accounts shall be valued in accordance with the accounting rules. According to the rules, investments in fixed-income instruments, such as bonds and loans, can be carried at amortised cost, while other assets shall be carried at fair value. The Ministry of Finance has approved amendments to the Accounting Regulations that will enter into force as of 1 January 2023. The criteria for when amortised cost can be used are tightened.

Finanstilsynet has previously proposed that all assets in client portfolios should be carried at fair value in the policyholders’ accounts, but the Ministry of Finance decided not to go ahead with this proposal. The Ministry of Finance instead asked Finanstilsynet to prepare a consultation document on how measurement at amortised cost in the policyholders’ accounts can be regulated in light of the changes to the accounting rules. Finanstilsynet sent the consultation document to the Ministry of Finance in November 2021. The Ministry had not circulated the consultation document for comment at year-end 2021.

Amendments to the solvency framework for insurers – Solvency II

In September 2021, the European Commission presented a proposal for amendments to the Solvency II framework. Finanstilsynet was somewhat involved in this process through pan-European cooperation in 2021. The proposal entails changes to insurers’ solvency capital requirement, greater emphasis on proportionality for small undertakings, strengthened supervisory cooperation between authorities related to cross-border activities and changes to risk management, reporting and disclosure requirements for the undertakings.

The commission has put forward proposed rules for insurers’ recovery plans and crisis management. Finanstilsynet was involved in this process through pan-European cooperation in 2021 as well.

Consultation document on the extension of the scope of the Non-Life Insurance Guarantee Scheme

The Non-Life Insurance Guarantee Scheme shall prevent or reduce losses for private individuals and small and medium-sized enterprises if their insurer is unable to fulfil its obligations. Norwegian insurers and insurers established in the EEA with a branch in Norway are members of the Non-Life Insurance Guarantee Scheme.

The Ministry of Justice and Public Security has proposed an extension of the coverage provided by the Non-Life Insurance Guarantee Scheme, whereby it will also guarantee payment of compulsory, statutory insurance policies taken out through insurers from the EEA selling insurance in Norway on a cross-border basis, for example through agents. This applies, for example, to occupational injury insurance and motor vehicle liability insurance.

On commission from the Ministry of Finance, Finanstilsynet prepared a consultation document in autumn 2021 proposing regulatory changes that are in line with the above proposal from the Ministry of Justice and Public Security. The proposal has not yet been circulated for comment by the Ministry of Finance.

Other supervised sectors:

-

Banks and other financing activity

-

Infrastructure in the securities area

-

Securities market conduct

-

Investment firms

-

Mutual funds and collective investment schemes

-

Approval of prospectuses – transferable securities

-

Financial reporting enforcement – listed companies

-

Auditing

-

International cooperation

-

Money laundering and financing of terrorism

-

Digital finance and IT risk