Insurance and pensions

Last published: 29 March 2023

Regulation and supervision of the insurance and pension sectors are important in safeguarding customers’ rights under insurance and pension contracts, and in instilling public confidence in the insurance market. The supervisory activities should help ensure that the undertakings are financially sound and safeguard customers’ rights and interests.

Facts about the insurance and pension industry

At year-end 2022, eleven life insurers, 51 non-life insurers and five small mutual marine insurers were licensed to operate in Norway. A further eight branches of foreign life insurers and 24 branches of foreign non-life insurers were operating in Norway. Norwegian non-life insurers had a total of twelve branches in other EEA states and four branches in countries outside the EEA. One Norwegian life insurer and 19 Norwegian non-life insurers had notified cross-border activities to other EEA states. 65 foreign life insurers and 411 foreign non-life insurers had notified cross-border activities from other EEA states into Norway.

48 private pension funds, 34 municipal pension funds, one pension fund in run-off and one defined-contribution pension undertaking were licensed to operate in Norway.

2 275 insurance intermediaries were listed in Finanstilsynet’s registry at the end of 2022: 64 insurance brokers, 13 of which also had a licence to operate as reinsurance brokers, one pure reinsurance broker, 394 insurance agents and 1 817 ancillary insurance intermediaries.

Developments

Life insurance and pensions

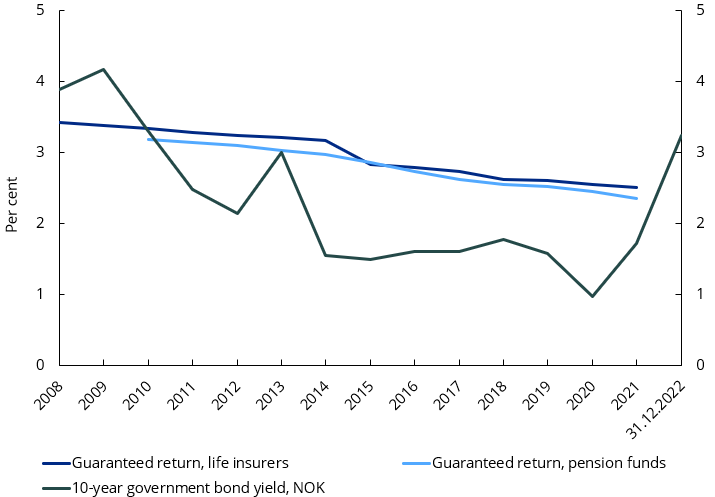

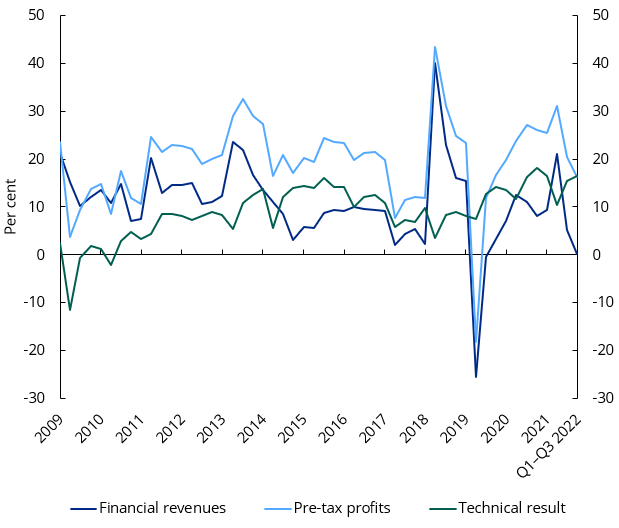

The risk-free market rate, represented by the 10-year Norwegian government bond yield, rose considerably in 2022 and is now at a far higher level than the average guaranteed rate of return in defined-benefit pension schemes (chart 1). Higher interest rates have caused a fall in bond prices. Combined with the stock market decline, this contributed to negative returns in pension institutions in 2022 (chart 2). The pension institutions' fluctuation reserves and buffer funds were reduced, and profits were weak.

|

Chart 1 10-year government bond yield and average guaranteed rate of return |

Chart 2 Adjusted return on pension institutions’ collective portfolios |

|---|---|

|

|

|

Sources: Finanstilsynet and Refinitiv |

* Annualised. Source: Finanstilsynet |

Non-life insurance

Financial market developments and a somewhat higher claims ratio contributed to a decline in profits among non-life insurers in the first three quarters of 2022 (chart 3).

|

Chart 3 Overall profits of non-life insurers as a percentage of premium income for own account for the year to date |

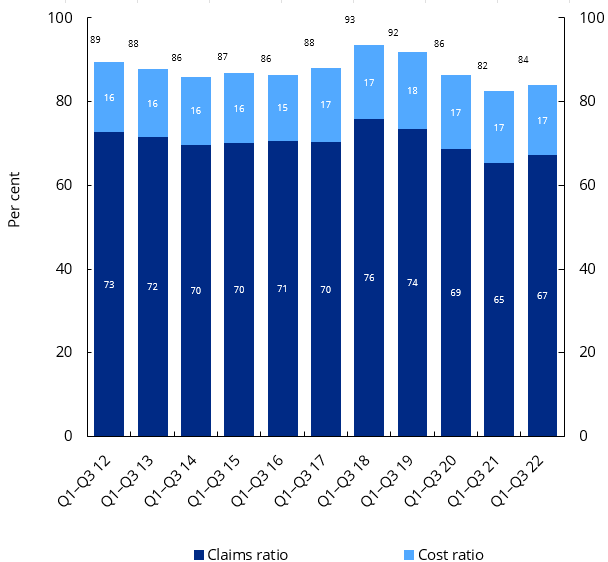

Chart 4 Life insurers’ total claims ratio and cost ratio for own account (net combined ratio)

|

|---|---|

|

|

|

Source: Finanstilsynet |

Source: Finanstilsynet |

Supervision, monitoring and control

Reporting from the undertakings

Based on reporting from the undertakings, Finanstilsynet prepares quarterly reports on the profitability and balance sheet composition of life insurers and non-life insurers, while reports for pension funds are prepared twice a year. The results for 2021 were published in the report on financial institutions’ performance (in Norwegian only) in February 2022 and also formed the basis for analysis in Finanstilsynet’s semi-annual Risk Outlook report.

In 2022, Finanstilsynet prepared a summary quarterly report on the solvency situation of financial institutions etc., including both insurers and pension funds (pension funds are included every six months). In addition, a more comprehensive report on insurers’ solvency situation at year-end 2021 was prepared, as well as semi-annual reports on pension funds’ solvency situation.

The undertakings’ solvency and financial reporting forms an important basis for the ongoing supervision of insurers and pension funds. Reported data are used in analyses of the undertakings and in their dialogue with Finanstilsynet and play a key role in ensuring that its supervisory activity is based on well-founded priorities.

Solvency of insurers and pension funds

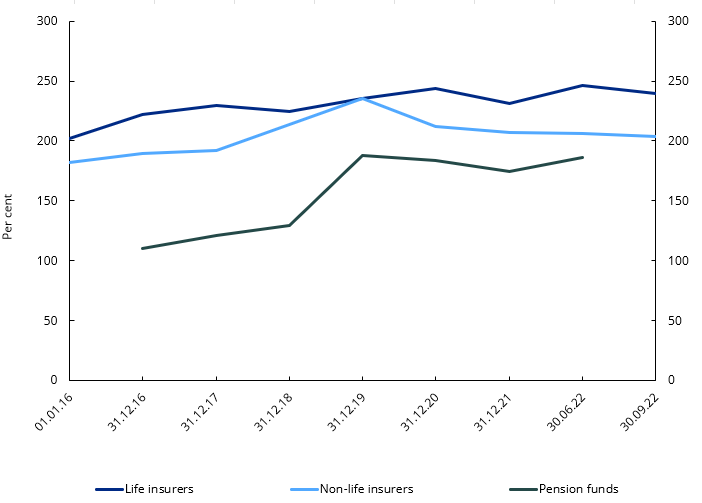

The rising interest rate level has helped improve the overall solvency of pension institutions since year-end 2021, as the present value of their liabilities has declined more than the value of their assets (chart 5). Partly owing to higher interest rates, the effect of the transitional measure on technical provisions has been reduced. The solvency report for financial institutions etc. as at 30 September 2022 provides a more detailed account of the transitional measure (in Norwegian only). As at 30 September 2022 and the end of the previous two quarters, the transitional

measure did not have effect for any life insurers, while it had effect for three insurers as at 31 December 2021.

The overall solvency of pension funds improved in the first half of 2022. For private pension funds, a reduction in the present value of insurance liabilities helped improve solvency, despite a decline in the unrealised gains reserves (fluctuation reserves). For municipal pension funds, the fall in the value of assets contributed to reduced buffer funds, negative interim profits and a slight decline in solvency ratios in the first half of 2022. On account of the increase in interest rates, the transitional measure has also had less effect for pension funds. The transitional measure had effect for a total of 18 private and seven municipal pension funds as at 30 June 2022, compared with 34 private and nine municipal pension funds as at 31 December 2021.

There has been a slight decrease in non-life insurers’ solvency ratios from year-end 2021.

|

Chart 5 Solvency position of insurers and pension funds |

|---|

|

|

The requirement for a solvency ratio above 100 for pension funds was introduced on 1 January 2019. |

On-site inspections

During on-site inspections, Finanstilsynet reviews the undertaking’s management and control system, including strategies and guidelines, organisation, monitoring and reporting, along with the undertaking’s risk level and capitalisation. Some on-site inspections also focus on specific themes or risk areas. After the on-site inspection is concluded, an inspection report is sent to the undertaking and published on Finanstilsynet's website.

On-site inspections are primarily a preventive supervisory activity. The dialogue with management and the board of directors provides the opportunity to guide and advise the institutions to enable necessary action to be taken at an early stage.

Finanstilsynet conducted on-site inspections at three life insurers in 2022. One of the inspections addressed overall risk management, market risk, insurance risk, technical provisions and anti-money laundering. An on-site inspection on the topic of customer service was also carried out, where the requirements of the new Insurance Distribution Act were followed up. The inspection also addressed the undertaking's adaptation to the new rules on product approval (POG), unit-linked products and complaints processing. An on-site inspection focusing on management and control of ICT activities was carried out at a life insurer.

Finanstilsynet conducted on-site inspections at two pension funds in 2022, one municipal pension fund and one private pension fund. At the inspections, the pension funds' management and control systems as well as their risk level and capitalisation were reviewed.

Finanstilsynet conducted on-site inspections at eight non-life insurers in 2022. Six of these were ordinary inspections addressing the insurers' management and control systems as well as their risk level and capitalisation. During two of the inspections, the undertakings' calculations of technical provisions were also on the agenda. Key themes at several of the inspections were the role and competencies of the board of directors, approval procedures for new products, the independence of control functions, external and intra-group outsourcing, as well as distribution models. One of the on-site inspections, at a non-life insurer, covered only its calculations of technical provisions. One of the on-site inspections addressed the follow-up of the undertaking's partial internal model.

Supervisory cooperation

Finanstilsynet participates in the European Financial Supervisory Authorities (EBA, ESMA and EIOPA). The cooperation includes both supervision of undertakings and markets and regulatory development. Through this cooperation, Finanstilsynet participates in peer reviews on supervisory practices in the EEA states. The cooperation is described in further detail in a separate report on Finanstilsynet's international activities (in Norwegian only).

The supervision of large insurance undertakings operating in two or more countries through subsidiaries or large branches is coordinated through supervisory colleges in which the various countries’ supervisory authorities are represented. Finanstilsynet heads the supervisory college for Gjensidige Forsikring ASA and Storebrand ASA.

In 2022, Finanstilsynet also participated in supervisory colleges for the following foreign insurance undertakings operating in Norway:

- Danica Pensjonsforsikring and Tryg Forsikring A/S (Denmark)

- If (Sampo) (Finland)

- Nordea Life and Pensions and Nordnet Livsforsikring AS (Sweden)

- Help Forsikring (Arag) (Germany)

Climate risk

Insurers and pension funds are exposed to climate risk. Non-life insurers are directly exposed to physical climate risk in their insurance portfolios, for example due to changes in precipitation and wind conditions. In addition, both their insurance portfolios and asset management operations are exposed to transition risk. Life insurers and pension funds' exposure to climate risk is mainly related to asset management. Climate risk was on the agenda at all ordinary inspections at insurers in 2022.

In recent years, Finanstilsynet has held meetings with a large number of non-life insurers on climate risk, and meetings with eight undertakings were held in 2022. The purpose of the meetings has been to identify how climate change may affect non-life insurers' risk and how they manage the risk.

Finanstilsynet has expectations regarding the insurers' handling of climate risk, both physical risk and transition risk, which is reflected in Finanstilsynet's risk module for evaluating the insurers' management and control. The insurers also assess climate risk in their annual report on their own risk and solvency assessment (ORSA), which is sent to Finanstilsynet.

Licensing

Establishments

No licences were granted for the establishment of new insurers and pension institutions in 2022.

Branches and cross-border activities

In 2022, one foreign insurer established a branch in Norway. This was Chopin Forsikring A/S, which is headquartered in Denmark. Several insurers established in another EEA state have notified cross-border activity into Norway.

In 2022, Finanstilsynet granted Assuranceforeningen Gard – Gjensidig, Gard Marine & Energy Insurance (Europe) AS, Protector Forsikring ASA and Assuranceforeningen Skuld (Gjensidig) permission to retain their UK branches after the expiry of the transitional arrangement for licences after Brexit.

In June 2022, Finanstilsynet granted Assurance Association Skuld permission to establish a branch in Japan.

Complaints Board for Insurance and Reinsurance Brokerage Business

Finanstilsynet acts as secretariat for the Complaints Board for Insurance and Reinsurance Brokerage Business. The board handles disputes between clients and brokers. One complaint was referred to the board for decision in 2022.

Mergers, acquisitions and demergers

In May 2022, Finanstilsynet gave Hålogaland Kraft AS' Pensjonskasse, Nordkraft Pensjonskasse and Lofotkraft Pensjonskasse permission to merge, with Hålogaland Kraft AS' Pensjonskasse as the acquiring pension fund. At the same time, Finanstilsynet gave Hålogaland Kraft AS' Pensjonskasse permission to convert to a joint pension fund, Nord Felles Pensjonskasse.

In June 2022, Storebrand ASA and Storebrand Livsforsikring AS were granted permission to acquire 100 per cent of the shares in Danica Pensjonsforsikring AS. At the same time, permissions were granted for the merger between Storebrand Livsforsikring AS and Danica Pensjonsforsikring AS, with the former as the acquiring company, as well as for the expansion of the group. The two group companies Storebrand Livsforsikring AS and Danica Pensjonsforsikring AS were also permitted to provide the same services until the merger is completed.

In May 2022, Storebrand ASA and Storebrand Livsforsikring AS announced the (indirect) acquisition of the Swedish life insurer S:t Erik Livförsäkring AB as well as temporary changes in its group structure as a result of the acquisition.

In June 2022, Fortum Pensjonskasse was granted permission to liquidate its pension fund.

In November 2022, Adresseavisen Pensjonskasse was granted permission to liquidate its pension fund.

In December 2022, Glommens og Laagens Brukseierforenings Pensjonskasse was granted permission to liquidate its pension fund

Business unrelated to insurance

In March 2022, the Ministry of Finance considered a complaint against a decision made by Finanstilsynet according to which Fremtind Forsikring AS was not allowed to issue tags for road toll through subsidiaries on the grounds that this represented business unrelated to insurance. The Ministry of Finance agreed with Finanstilsynet that the issue of tags for road toll represents business unrelated to insurance, but granted Fremtind Forsikring AS an exemption from the provisions of the Financial Institutions Act, whereby the insurer may own and operate issue activity through its subsidiary Fremtind Service AS.

Cooperation agreements

In June 2022, Finanstilsynet approved a distribution agreement between Danica Pensjonsforsikring AS and Danske Bank, which is the Norwegian branch of Danske Bank A/S.

In September 2022, Finanstilsynet approved a cooperation agreement between BNP Paribas Cardif Livsförsäkring AB, BNP Paribas Cardif Försäkring AB and Lendo Part of Schibsted AS on insurance mediation.

Non-Life Insurance Guarantee Scheme

Finanstilsynet acts as secretariat for the Non-Life Insurance Guarantee Scheme (the Guarantee Scheme). The purpose of the Guarantee Scheme is to prevent or reduce losses for private individuals and small and medium-sized enterprises if their insurer is unable to fulfil its obligations. The Guarantee Scheme is headed by a board of five members.

The Danish non-life insurer Alpha Insurance A/S went bankrupt on 8 May 2018. The Guarantee Scheme assumed that Norwegian claimants were covered by the Danish Guarantee Fund for Non-Life Insurers, but decided to make advance compensation payments. The Guarantee Scheme brought a lawsuit against the Guarantee Fund to verify this. The Guarantee Fund was acquitted, and the final judgment was passed by the Danish Supreme Court on 5 January 2023.

The first payment from the Guarantee Scheme to cover claims against Alpha's Norwegian branch was made in December 2019. So far, more than NOK 9 million has been paid. The Guarantee Scheme will continue to cover compensation claims as and when the bankruptcy administrators forward completed compensation cases.

Policyholders who have taken out insurance policies directly from Alpha in Denmark via insurance brokers are not entitled to coverage through the Norwegian Guarantee Scheme.

Regulatory development

PEPP

PEPP is a pan-European personal pension product for EU citizens. In February 2022, Finanstilsynet submitted a draft consultation document to the Ministry of Finance proposing how the EU's PEPP Regulation can be implemented in Norwegian law. The regulation regulates a standardised pension product that functions as a personal, non-labour market related pension savings product that is acquired voluntarily by a natural person for long-term saving for retirement. The product is complementary to existing government and private pension schemes and is not intended to replace or harmonise existing national individual pension savings schemes. According to the regulation, no one is required to offer the PEPP product, but only products registered under the rules of the regulation can be marketed and distributed in the EU under the designation ‘PEPP’. The draft consultation document is under consideration by the Ministry of Finance.

IORP II

Provisions in laws and regulations that implement Directive (EU) 2016/2341 on the activities and supervision of institutions for occupational retirement provision (revised Occupational Pension Directive, IORP II) entered into force on 1 January 2023. The amendments concern requirements for corporate governance, control functions, cross-border activity, additional requirements for the submission of information to members of pension schemes, and supervision. The rules have mainly been implemented through amendments to the Financial Institutions Act and the Regulations on Pension Institutions. The amendments are based on a consultation document prepared by Finanstilsynet in 2019.

New Insurance Intermediation Act

The new Insurance Intermediation Act and regulations thereto entered into force on 1 January 2022. At the same time, some amendments were made to the Financial Institutions Act and the Insurance Contracts Act. The purpose of the new rules is to strengthen consumer protection in connection with the sale of various insurance products. The new rules apply to all insurance distribution, i.e. insurance intermediation and insurers’ sale of insurance policies. They are largely a continuation of existing regulations and practices, but also include new requirements relating to information and advisory services, continuing education, corporate governance and financial performance. The new requirements increase the need to follow up undertakings' insurance distribution. In 2022, Finanstilsynet adapted its supervisory practices to the new rules, which included focusing more on consumer protection.

The new Insurance Intermediation Act entails changes in the registration obligation for insurance agent firms. Previously, only agent firms for foreign insurers were required to be registered in Finanstilsynet's business registry. According to the new Act, all agent firms must be registered with Finanstilsynet. This also applies to ancillary agents and agents who have entered into agreements with the insurer’s agents, so-called sub-agents. In 2022, there were 1 798 registered ancillary insurance intermediaries and 330 registered insurance agent firms.

After the introduction of the new Insurance Intermediation Act and Regulations, there have been more inquiries and questions from the industry about how the regulations should be interpreted, including the new requirements for registration of insurance agent firms and continuing education. Finanstilsynet has provided guidance in individual cases and on its topic page on finanstilsynet.no.

In 2022, Finanstilsynet prepared a consultation document proposing new regulations on reporting for insurance intermediaries. New rules were laid down in regulations and entered into force in November 2022.

Guidance

In 2022, Finanstilsynet provided guidance by publishing information on finanstilsynet.no, This included:

- inspection reports

- circulars providing guidance on Finanstilsynet’s supervisory practices

- descriptions of new legislation on separate topic pages

- consultations on draft legislation, both from Norway and EU consultations of relevance to the EEA

Finanstilsynet also gave lectures at several seminars organised by, among others, the Norwegian Association of Pension Funds, the Norwegian Association of Actuaries and Finance Norway.

More information at finanstilsynet.no

Other supervised sectors:

-

Banks and other financing activity

-

Infrastructure in the securities area

-

Securities market conduct

-

Investment firms

-

Mutual funds and collective investment schemes

-

Approval of prospectuses – transferable securities

-

Financial reporting enforcement – listed companies

-

Auditing

-

International cooperation

-

Money laundering and financing of terrorism

-

Digital finance and IT risk